Primary market share 50% higher under CBPP2, ECB reveals

The European Central Bank has revealed that 40% of purchases under its second covered bond purchase programme (CBPP2) were in the primary market and 60% in the secondary, reflecting a sharp increase in buying of new issues relative to CBPP1.

Wilfried Baum, head of portfolios section at the Deutsche Bundesbank, said on 3 February that relative to CBPP1, there is “much more focus this time on the primary market”, and the figures reflect this bias.

Under the first, Eu60bn covered bond purchase programme that ran from mid-2009 to mid-2010, the secondary market accounted for 73% of buying and the primary market 27%, with CBPP2′s 40% share representing a 48% increase on this.

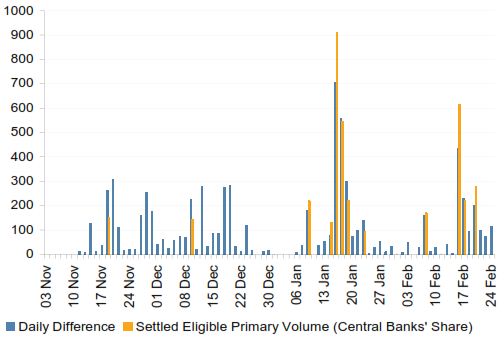

The figures for CBPP2 reflect Eurosystem purchases up to 31 January, so the primary market’s share may be even higher, with five Spanish benchmarks having been launched since then as well as eligible supply from Austria, France and Germany. Recent large increases in the CBPP2 total have coincided with the settlement of Spanish and French new issues for which Eurosystem buying had been reported, as noted by RBS analysts in the following chart.

Daily purchase volumes under CBPP2 versus central bank participation in eligible primary benchmark deals

Source: ECB, RBS

RBS’s analysts expect the breakdown to move towards 50:50 by the end of February.

“The cumulative volume in new CBPP2-eligible benchmark issues bought by central banks in February totals Eu1.285bn (also including non-Eurozone central banks),” they said. “The purchases under CBPP2 on these dates add up to Eu1.024bn compared to total purchases of the Eurosystem under CBPP2 of Eu1.574bn in February so far.”

They suggested that the greater primary market focus of CBPP2 could explain why it is lagging the average rate necessary for the Eu40bn assigned the programme to be spent by the time it ends.

“The current gap between the theoretical run-rate (assuming an even allocation across the one year horizon of the programme) and the actual cumulative purchase volume suggests that the primary market activity so far has not been sufficient to absorb the available volumes under CBPP2,” they said. “This also reveals the weak point of this approach: since a focus on the primary market means being reactive, the programme can support a positive trend in the primary market, but is less likely to be the catalyst for a trend reversal.”