Wishful thinking seen as Spaniards set out cédulas LCR case

Cédulas hipotecarias are suitable as Level 2 and even Level 1 assets under new liquidity buffer rules on account of the market’s liquidity, depth and price movements relative to government bonds, according to a study for the Spanish Mortgage Association, but some market participants have expressed scepticism about the report’s arguments.

Carried out by Analistas Financieros Internacionales (AFI) on behalf of the association, the report was published on 25 April and sent to regulators on 4 May. It analyses the size and importance of the cédulas hipotecarias market, term to maturity, price movements and liquidity, to argue that the asset class “allows the diversification pursued by Basel, while introducing standards of depth, liquidity, and pricing, comparable to those of Treasury Bonds, in a higher proportion than the average in the most important European Covered Bonds markets”.

Writing in an EMF Mortgage Info publication, Lorena Mullor, manager, Spanish Mortgage Association (AHE), said that achieving the best possible recognition of covered bonds with respect to short and long term liquidity requirements under Basel III and CRD IV rules is a priority for the European covered bond industry and that it is in particular very important for the Spanish mortgage market that cédulas hipotecarias are considered high quality and highly liquid assets for the purpose of liquidity coverage requirements.

This is because of the size of the cédulas hipotecarias market, with an estimated 30% of each cédulas issue held in the liquidity reserves of European banks, for which it is important cédulas remain a suitable investment.

“Being suitable for the LCR,” she added, “they allow Spanish financial institutions to have a resource with well known risks and characteristics to act as a liquidity reserve (to use as a discount for central bank funding or for market repurchase operations).”

The report was commissioned to provide empirical evidence that Spanish mortgage backed covered bonds meet all quality and liquidity requirements set by Basel III, she said, with the relevant information to be provided to the European Banking Authority (EBA).

The EBA is the authority in charge of deciding on what basis asset classes will be deemed to qualify for Level 1 or Level 2 liquidity buffers under the EU Capital Requirements Directive (CRD).

AFI’s report highlighted the importance of the cédulas hipotecarias market in terms of its size, in particular relative to GDP and public sector debt, before arguing that the average term to maturity of Spanish mortgage covered bonds (5.2 years), along with the reliance mostly on public rather than private placements of bonds, “gives the Spanish market a greater potential to be used actively as a benchmark in liquidity management”.

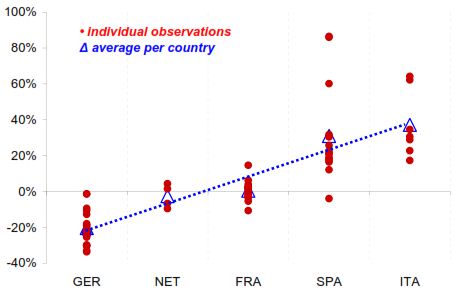

With respect to the behaviour of Spanish mortgage covered bond spreads, the analysts said that the correlation between mortgage covered bonds and government bonds is higher in Spain than in other jurisdictions such as France, Germany or the Netherlands, where covered bonds are priced closer to the swap curve and feature a larger spread versus their benchmark government bonds. By contrast, the correlation with the swap curve is much lower in the case of cédulas hipotecarias (CH) than the one observed in those countries, where such correlation is very high.

Correlation between a selection of European covered bonds and their respective sovereigns (residual average life approximately five years)

Source: Afi, Merrill Lynch, Reuters

In addition, the spread between cédulas hipotecarias and Bonos is much more stable than the one between Pfandbriefe and Bunds, according to AFI.

“It is concluded that the CH behave much more like their Treasury bonds, while other European CB are more comparable to swap instruments,” said the report.

Also supporting the case for Level 2 and even Level 1 LCR eligibility, according to AFI, are the liquidity ratio and bid-ask spreads in the cédulas hipotecarias market.

The liquidity ratio, defined as the trading volume relative to the outstanding amount, in the CH market is very stable and very high, around 50% per month, said the analysts, noting that although the ratio is lower than that in government bonds it is much higher than in other markets such as equities.

The report also mentions as noteworthy that other countries do not release information about trading volume, which makes the cédulas hipotecarias market more transparent compared with other covered bond markets.

Bid-ask spreads are more important than trading volume when it comes to liquidity, the report added, and for Spanish mortgage backed covered bonds the spread is on average four times that of Spanish Treasuries.

“That same bid-ask spread exceeds five times in France or The Netherlands, and more than 10 times in the German case,” said AFI.

Bid-ask spreads of covered bonds and sovereigns (residual average life approximately five years)

Source: Afi, Reuters

AFI’s report also calls for a more favourable treatment of cédulas hipotecarias under the European Central Bank’s repo framework, arguing that in terms of haircuts applied by the ECB the treatment of cédulas is “asymmetric” compared with that of German Pfandbriefe and that this does not fit with sovereign debt considerations in ECB liquidity terms.

Relaying the report’s conclusions, Mullor at AHE said that based on the evidence provided in AFI’s report cédulas hipotecarias should be considered as a homogeneous set of assets and, together with the rest of covered bonds, should be unquestionably considered a liquid asset.

“Moreover, given the importance of this market, the high correlation seen between CH and the Spanish Treasury, as well as their high liquidity and historical price stability, it could be considered at a higher level of liquidity regarding Basel III,” she said. “That is, at level 1, where public debt – with which it shares many common features – will also be considered.”

Market participants were sceptical about the report, saying that it smacked of “wishful thinking” or was “absurd”.

A banker said that the report is correct to focus on de facto liquidity rather than any perceived credit quality, bearing in mind that the EBA’s analysis of asset suitability for LCR purposes is supposed to be about the ease with which the bonds can be liquidated, and not the likelihood of them being downgraded.

“But the central plank of the argument – that Spanish and German government bonds get the same liquidity treatment and that the difference between govvies and covereds is less in Spain than in Germany – is at best an optimistic way of looking at it,” he said.

Others were also critical of the argument presented.

“The most striking element in this presentation is that AHE mixes up the individual strength of cédulas with the individual weakness of the Spanish sovereign,” said an analyst. “They derive from the small pick-up CH pay over Spanish government bonds that cédulas are strong.

“In fact the conclusion should be that compared to other countries, cédulas are comparably less rubbish than the resident sovereign.”

A Spanish market participant felt that the report contains a few misunderstandings, such as with respect to the haircuts under the ECB’s repo framework.

“We know that cédulas are in group three in the ECB discount window, but we don’t know if some or all Pfandbriefe are in group two,” he said, “and they shouldn’t be because to be in group two you need market-makers, and as far as we know no-one has market-makers now.”

Cédulas should be, and to his knowledge are, treated in line with Pfandbriefe in all relevant regulations, such as Basel III, he said, adding that the differences between the liquidity categories II and III for repo with the ECB are in any case not that significant.

In addition, he questioned the accuracy of the liquidity ratio that the report gives for the cédulas hipotecarias market – 50%, saying that it is “impossible” that 50% of volumes are moved every month.

“They’re claiming there is huge liquidity, there is no liquidity,” he said. “Pretending that cédulas look more like Spanish Treasuries than Pfandbriefe look like Bunds is absurd.

“It’s true that cédulas, especially multi-cédulas, are so systemic that you could think the risk is like Treasury risk and in some cases could be even more secure, but that could be the same for any other covered bond because in the end if you are at risk holding a government bond it might be that the covered bond is better.”

AFI’s report says that the turnover ratio corresponds to the ratio of the monthly traded size over the total outstanding amount in a given month, noting that a fast turnover ratio “is what creates real liquidity and is a positive indication of the quality and liquidity level in both covered and government bond markets”.

An analyst said that the report is fairly well prepared and thought through, but that while it makes sense to try to argue that cédulas hipotecarias are comparable with government bonds this would be to no avail.

“In particular in the event of a bankruptcy of the state I would rather be holding cédulas hipotecarias than Bonos,” he said, “but on the other hand you would be setting a certain precedent and if this initiative were to be successful you would very quickly have the likes of the vdp arguing that if Spanish covered bonds count as Level 1, what about Pfandbriefe?

“I would be surprised if they think this is going to work.”

The Association of German Pfandbrief Banks (vdp), Association of Danish Mortgage Banks (Realkreditrådet) and others have sought better treatment of covered bonds under liquidity buffer requirements, and are said to be striving to pitch their national instruments as Level 1 LCR assets, although the analyst said he does not think this will be achieved.

“You can’t go about this too aggressively,” he said, “and Level 2 is already not bad.”

And although he was fairly complimentary about the report he said that the timeframe of the analysis is problematic, and that the same arguments would be much more difficult to put forward if they were based on a longer time period, of 10 years, for example.

“The volatility of covered bonds is higher and when you look at absolute spread levels even only five years ago government bonds were the measure of all things,” he said.

Mullor at AHE, told The Covered Bond Report that the study was carried out to present and defend cédulas as a homogeneous asset class and not to defend it against other instruments or other covered bonds.

“We want regulators to know that our covered bond has quality, security and liquidity enough to be one of the asset classes to include in LCR (tier I or II) as other covered bonds,” she said. “That is all.”

She said that the association has not yet received any feedback from the EBA, but that the Spanish supervisor has welcomed the cédulas industry’s efforts to highlight the quality of the asset class.

Echoing some of Mullor’s comments, Miguel Arregui, senior analyst at AFI, said that the aim of the study was to argue that cédulas hipotecarias can be assessed as a homogenous asset class, and to reinforce and highlight the quality of Spain’s local covered bond market.

“We also argue that those similarities offset the differences between cédulas hipotecarias and government bonds that are, by far, few and less important, and also less important than those seen in other jurisdictions,” he said. “From this point of view and talking about LCR perspective, if government bonds are considered as assets that fit within liquidity level 1, usually regardless of their ratings, credit profiles, spreads, yields levels, and even liquidity measures, cédulas hipotecarias should also be considered as liquid assets; if not in level 1, at least in level 2.”

The evidence, he added, is that since at least 2010 cédulas hipotecarias are government bond instruments.

“The way we see it, there is no doubt on that point,” he said.