BRFkredit details its share of Dkr160bn Danish September record

BRFkredit will be holding sales of non-callable bullet bonds for the refinancing of adjustable rate mortgages (ARMs) in the week of 27 August, it announced today (Friday), with its expected Dkr17bn (Eu2.28bn) contributing to what Danske Bank analysts expect to be around Dkr160bn in total from Denmark’s mortgage credit institutions (MCIs).

Alongside BRFkredit, Nykredit is auctioning some Dkr105bn of bonds, as reported yesterday (Thursday), while Nordea Kredit expects to sell some Dkr22bn. DLR Kredit has not yet announced the volumes it will be refinancing, but Danske analysts expect around Dkr11.3bn of fixed rate issuance from the bank.

Alongside BRFkredit, Nykredit is auctioning some Dkr105bn of bonds, as reported yesterday (Thursday), while Nordea Kredit expects to sell some Dkr22bn. DLR Kredit has not yet announced the volumes it will be refinancing, but Danske analysts expect around Dkr11.3bn of fixed rate issuance from the bank.

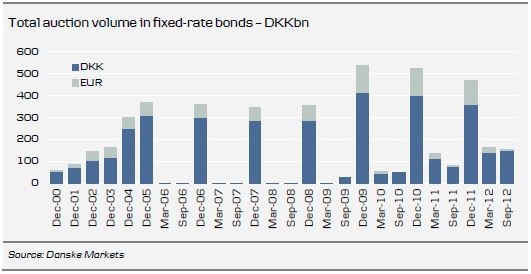

“A total volume of just over Dkr150bn in fixed-rate non-callable bonds is double the amount seen at last year’s September auction and indeed both the March and September auctions have gradually expanded in recent years,” said Danske Bank analyst Christina Falch – see chart below. “As mentioned, Nykredit will also sell around Dkr8bn in FRNs, bringing the total auction volume to almost Dkr160bn.

“As at previous refinancing auctions, we expect to see a spread across the various MCIs at the September auctions,” she added. “Nykredit/Totalkredit will be the largest supplier of October bonds at the auction and therefore Nykredit’s bonds are expected to trade cheaper (greater spread to CITA/swaps) than Nordea Kredit, while BRFkredit and DLR Kredit bonds are expected with a pick-up relative to Nykredit’s bonds.”

Almost all, Dkr14.8bn, of BRFkredit’s sales will be one year SDOs issued out of capital centre E, with the rest split between further sales out of the capital centre and sales of ROs out of capital centre B.