Post-summer blues deemed unlikely despite historic lows

A scarcity of summer issuance may have intensified a tightening of covered bond spreads, but new benchmark deals can still be sold even at such “eye-catching” levels, according to bankers, and while some widening is expected, modest supply means a wave of repricing akin to last year is not foreseen.

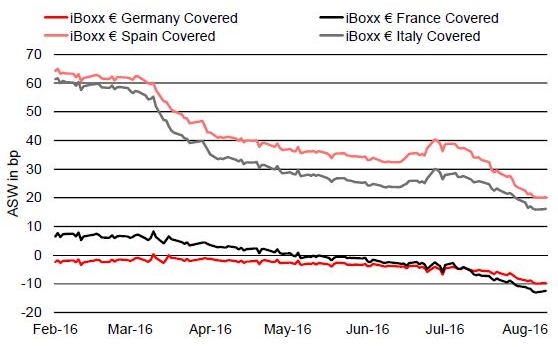

The current rally in spreads began in March, bankers noted, but has intensified over the last three weeks amid a lack of supply, with the last sizeable issuance before a Commerzbank tap today (see separate article) coming on 20 July. This has taken spreads in some jurisdictions to levels in line with the historical lows recorded between June and August of last year.

“In the last few weeks, already compressed spreads have ground substantially tighter,” said a banker. “Not much surprises in this market these days, but some of these levels are especially eye-catching.”

Market participants said the tightening trend is highlighted by the fact that some French covered bonds have since July been quoted inside German Pfandbriefe.

“It was painful enough to see the German football team dominate the early going in the Euro 2016 semi-final against France to then be beaten 2:0,” said Florian Eichert, head of covered bond and SSA research at Crédit Agricole, “but in the covered bond space?”

Covered bond swap spreads

Source: UniCredit

Bankers also pointed to top tier Spanish and Italian issuers, whose covered bonds are in the five year part of the curve have been quoted only around 15bp wider than German Pfandbriefe, and to UK issuers, whose covered bond spreads have already retraced post-Brexit referendum widening.

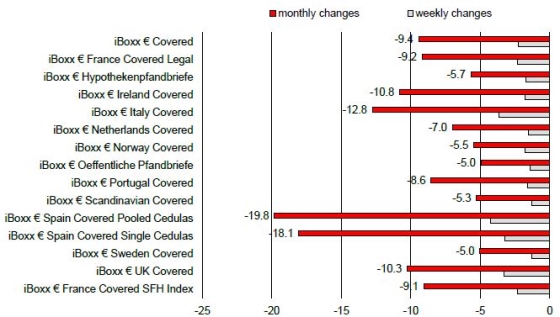

Analysts at UniCredit noted that as of Monday, the iBoxx Euro Covered index had tightened 9.4bp month-on-month. Some of the biggest moves were in peripheral countries, with the iBoxx Euro Spain Covered Single Cédulas index having tightened 18.1bp month-on-month, and the iBoxx Euro Italy Covered 12.8bp. The iBoxx Euro UK Covered tightened 10.3bp

Changes in spreads vs swaps (basis points, as of 8 August)

Source: UniCredit

Bankers said that the most important factor driving covered bond spreads this year has been the European Central Bank’s covered bond purchases, and said the lack of supply during the summer period with ongoing – albeit reduced – ECB secondary market buying is responsible for the increased tightening of recent weeks.

“Even though the market has already dried up to a certain degree, the ECB remains an active buyer and is thus driving prices higher,” said analysts at UniCredit.

A syndicate official agreed, stating that few accounts had been active in secondary markets over the last few weeks save for the central banks.

“This new compression is on the back of almost no turnover, and there are few trades happening at these levels,” said a syndicate official. “It is mainly a function of the scarcity of summer supply.

Bankers said these dynamics were demonstrated by the more substantial tightening of French spreads versus that of German Pfandbriefe. They said this was caused by lower supply and higher ECB secondary purchases in the French market – with German issuers having sold nine deals since 1 June, including four new benchmarks and five taps, while a Eu1bn CFF issue on 14 June was the only deal from France over the same period.

Crédit Agricole’s Eichert said that French covered bond supply in June and July was a net negative Eu4bn, while he estimated that over the same period the Banque de France bought around Eu2.6bn of French covered bonds on the secondary market. The German market saw positive net supply of Eu1bn, and estimated CBPP3 buying of around Eu600m.

However, analysts at DZ Bank noted that the beginning of the rally in March did not coincide with increased overall CBPP3 purchases, but rather that the ECB has scaled down the volume of monthly purchases since then.

“In principle, only one conclusion can be drawn here: demand from private investors has picked up again and, given the recent slackening of new issue activity, excess demand has been created in the covered bond market as a result,” said Günther Scheppler, senior covered bond strategist at DZ. “In our view, the fact that the ECB is reining in its purchase volume and that the resulting demand gap is being filled by private demand is a healthy trend.”

Room for more

Syndicate officials expect the euro covered bond market to reopen fully for benchmark issuance either on the week commencing 22 August or the week afterwards, and said there is still room for covered bond spreads to tighten further before then.

“It will be interesting to see whether these levels are reflected in new trades, but personally, I see no reason deals can’t be done at such prices,” said a banker. “The structural imbalance in this market – with very limited supply and high demand – is still in full force, and I don’t think issuers coming to the market will voluntarily surrender 5bp-10bp to compensate investors.

“The secondary market levels at which deals are quoted are still the levels you should use for pricing assumptions.”

Other syndicate officials agreed, noting that yesterday (Thursday), a Eu750m 10 year issue for the Federal State of Rhineland-Palatinate was priced at mid-swaps minus 15bp, on the back of a Eu1.4bn book, comprising around 70 accounts.

“To be honest, there was room to tighten by a couple more basis points,” said a syndicate official at one of the leads. “And if you look at recent weeks and months, there has not been much difference between the new issues for supras and new issues of Pfandbriefe.”

He noted that on 2 June last year, a MünchenerHyp Eu750m June 2023 issue – one of the joint-tightest benchmarks of the year – was priced at 17bp through mid-swaps with a pick up of 20bp versus Bunds. He said that triple-A Pfandbrief curves are now around 30bp above Bunds.

“There is still a way we could go, and still some room for more performance,” he said.

However, bankers said it is unlikely that French issuers will be able to sell more than one or two new issues at current spread levels, given that German investors are the biggest non-central bank buyers of euro covered bonds.

“We will still have more redemptions in France than in Germany in September but strongly believe that France trading inside Germany is a temporary phenomenon,” said Eichert. “After all, should new issuance pick-up again, even if only moderately, the Eurosystem will be able to put less pressure on secondary French covered bond markets.

“At the same time, we struggle to see sizeable demand – beyond maybe the first deal or so – from German investors for French covered bonds inside Pfandbriefe.”

A repricing wave?

The reopening of the euro market will lead to spread widening across jurisdictions either at the end of August or in September, bankers expect, but they foresee only modest moves.

“The first movers will have the advantage – with the full attention of the market and no recent comparables – and will be able to offer only a slim NIP, of 0bp-3bp,” said a syndicate official. “When supply picks up, the followers will probably have to pay up a bit more for differentiation, but we are talking about higher premiums – not the kind of widening we saw last year.

“I would be very surprised to see a wave of repricing in the manner of last year.”

After covered bond spreads reached similarly tight levels at the end of last summer, spreads began widening substantially, by up to 40bp for some issuers, on the back of increased supply. Market participants said the direction of travel will be the same this year, but that the scale of the widening will be tempered by relatively lower levels of issuance.

They said this is partly because many issuers are already well advanced with their funding plans, with the first half of 2016 having been the busiest first half of a year in terms of euro benchmark covered supply since 2011, and with new series of targeted longer-term refinancing operations (TLTRO II) from the ECB expected to reduce supply from the periphery in particular.

“We do expect only a partial repeat of last year’s story, despite August feeling exactly like it did back then,” said Eichert. “The extent of any widening will be much less pronounced than was the case last year as we expect the amount of potential issuance to hit markets to be much less pronounced as well.”

On 27 July, analysts at ABN Amro lowered their forecast for supply in the second half of the year by Eu10bn, stating that they now expect Eu141bn of euro benchmark covered bond supply in 2016, implying that some Eu50bn will be launched in H2. Other analysts also lowered their forecasts earlier this summer.

“Strong issuance in 2016 H1, the possibility to take up money for nothing in the TLTRO II for banks in the Eurozone, the need to meet capital requirements, as well as reduced liquidity needs more generally, are the main factors driving the downward revision of our forecast,” said Joost Beaumont, senior fixed income strategist at ABN Amro.

DZ Bank analysts meanwhile highlighted other potential risks that could contribute to widening.

“A mixed bag of risks, including among others the elections in the United States, political instability in Spain, the risk of an economic downturn in the UK, and the danger posed by an increasing number of terrorist attacks in Europe, may cause spreads in the covered bond segment to widen in the months ahead,” said Scheppler.