Record year eyed as bumper supply comfortably digested

Record full-year euro benchmark covered bond issuance is being forecast after a week with 10 deals totalling more than €8bn, with the market holding up well in the face of the issuance onslaught, even if deals beyond seven years did not enjoy the bumper books of shorter dated trades.

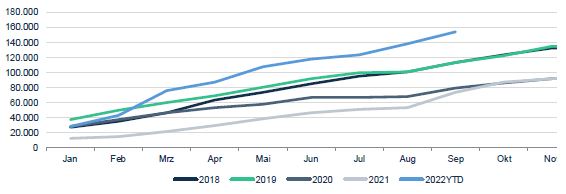

A €500m six year green covered bond from Eika Boligkreditt yesterday (Thursday) took supply for the week to 10 deals (11 tranches) totalling €8.25bn, bringing year-to-date issuance to some €155bn.

A €500m six year green covered bond from Eika Boligkreditt yesterday (Thursday) took supply for the week to 10 deals (11 tranches) totalling €8.25bn, bringing year-to-date issuance to some €155bn.

DZ analysts had in the summer revised their full-year forecast to this level and already last Friday noted it now seemed too cautious, with a volume of €170bn-€180bn looking more realistic. On Wednesday, Deutsche Bank strategist Bernd Volk said that supply is heading to a full-year record, noting the greater number of potential issuers today than when the current record of some €182bn was set in 2011.

LBBW analysts echoed this sentiment.

“We attribute this performance to the very strong issuance activity in the last month after the summer break, which saw over €31bn placed in this period alone,” said LBBW senior investment analyst Rodger Rinke, “surpassing many issue volumes recorded in recent years in the traditionally strong month of January.”

Euro benchmark issuance, y-o-y comparison (EUR bn)

Source: LBBW Research

Syndicate bankers said the primary market has been holding up better than might have been expected.

“It’s a relief for both issuers and investors that the covered bond market is working, spreads are fine, and execution is good,” said a syndicate banker, “especially compared to the rest of the funding instruments. Even on a day when there’s CPI data or a monetary policy decision, is there room for a shorter German Pfandbrief? For sure.

“What could derail it? If people have had enough with all the supply, even with the NIPs on offer. If they’re fully invested, nervous about liquidity. But I said that a week ago and it still goes on.”

He noted that even niche offerings that typically require a buoyant backdrop have been succeeding, such as a €300m five year debut for Islandsbanki on Monday.

Yesterday’s €500m six year green covered bond from Norway’s Eika Boligkreditt marked a strong end to the week, attracting a final order book above €2bn, and with the pricing tightened 5bp from the 17bp area to 12bp.

“Eika doesn’t always get the biggest order books,” said a banker away from the leads, “and it’s not as if investors have been starved of Norwegian supply, so the book looks really good. The IPTs made sense in a busy market where you’re seeking investors’ attention, and we saw fair value at about 7bp-8bp, so the NIP is in line, and overall it’s a really good outcome for Eika.”

The performance was also reflected the generally stronger results achieved by euro benchmarks in shorter maturities than long dated issuance this week.

A €750m long nine year for DZ Hyp on Tuesday was tightened 3bp to 7bp on the back of a €870m book, which one banker described as an uphill struggle, and even a €1bn long seven year for ING priced at 9bp with a book above €1.4bn was deemed “modest by their standards”.

“Seven years is the end of the party zone,” said the syndicate banker. “If you look at the curve today, we are almost flat, with even a little dip – two years at 2.53%, five years at 2.50%, 10 years at 2.56%. That’s not much of a curve – you’re not even getting a basis point per year, and in spread terms you’re not exactly treated exuberantly, either.

“Those who picked the shorter tenors were proven right: four year Helaba, five year NordLB, six year Eika and five year Sparebanken Vest – excellent stuff.”

NordLB attracted over €2.6bn of orders to its €500m green Pfandbrief on Monday at plus 1bp, while Helaba drew some €3.7bn of demand to its €1.5bn four year Pfandbrief, allowing it to tighten pricing to minus 3bp and a NIP of around 1bp. Sparebanken Vest Boligkreditt meanwhile priced a €750m five year at 10bp on the back of a final €1.2bn book.

A €500m 10 year tranche of a Deutsche Bank dual-tranche Pfandbrief on Monday was “the exception that proved the rule”, according to one banker, who said the scarcity of the credit helped it achieve a book above €1.5bn – the €1bn five year tranche drew over €1.9bn of demand, with the two tranches priced at 12bp and 4bp, respectively.

The market also proved accommodating of further Austrian supply: on Monday Erste Bank issued a €750m eight year at 16bp, while UniCredit Bank Austria raised €500m in a five year trade at 10bp on Tuesday.

As well as Islandsbanki’s sub-benchmark, Finland’s POP Mortgage Bank priced on Tuesday priced a €250m three year at mid-swaps plus 26bp, on the back of a €515m book, pre-reconciliation.

Issuance is expected to ease next week, with the recently-scheduled UK public holiday on Monday and many market participants expected in Vienna from Tuesday for ECBC/Euromoney events.