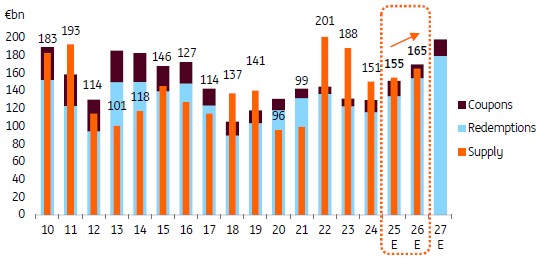

2026 supply of €160-170bn flagged as ‘tipping point’ nears

Early forecasts for next year’s euro denominated benchmark covered bond issuance are coming in at €160bn-€170bn, likely around 10% up on this year’s supply, with a pick-up in lending seen nudging volumes higher, although analysts suggest net issuance amounts are relatively digestible.

Year-to-date 2025 issuance stands at around €147bn, with little more than €150bn expected before year-end, and forecasts published so far average around €165bn, with some covered bond analysts expressing this specifically and others a range of €160bn-€170bn.

A consensus view is that bank lending will pick up to the extent that it lifts covered bond issuance – even if a direct correlation is not necessary, given banks’ flexibility to react, for example with senior unsecured issuance, as Florian Eichert, head of covered bond/SSA research at Crédit Agricole CIB, notes.

“However,” he adds, “we do get the feeling that we are slowly approaching a tipping point where the first banks are getting more attentive to these flows and where some of the larger ones are taking action in funding markets in anticipation of the balance tilting further towards loan growth outpacing deposit growth.”

Maureen Schuller, head of financials sector strategy at ING, echoes the view that lending is among key factors set to drive supply. She suggests that while issuers may again focus on unsecured issuance at the start of the year, covered bond issuance has scope to pick up thereafter.

“Covered bond supply will become more dominant once spreads come under more pressure and investors start seeking safer assets,” she says. “Mortgage lending growth is expected to accelerate, and record covered bond redemptions in 2027 (€180bn) will also ensure an active primary market for covered bonds in the second half of next year.”

Covered bond supply will rise on higher redemptions

Source: ING

Although gross issuance could climb 10%, €156bn of redemptions in 2026 – €22bn more than this year – mean that net supply will fall, to around €10bn.

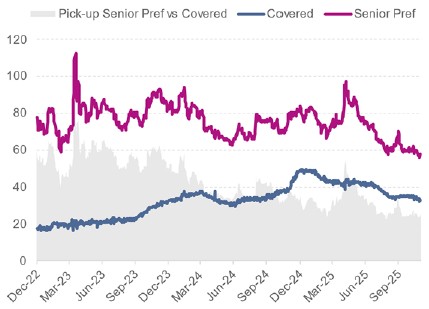

The unsecured supply Schuller cites has this year been spurred in part by the tight levels available to issuers, and Jennifer Levy, senior covered bond analyst at Natixis, is among those anticipating ongoing competition from senior debt for covered bonds for this reason.

“Supply may face challenges due to a narrow spread differential between senior preferred and covered bonds,” she says. “According to our bank analyst, senior preferred spreads should continue to be driven by technicals and particularly inflows while fundamentals should remain stable at strong levels.”

Senior Preferred vs. covered bond spreads

Source: iBoxx, Natixis

Levy and other also note competition for euro benchmark supply from issuance in other currencies, not least from issuers from jurisdictions such as Australia, Canada and the UK, with regulatory considerations today and going forward a consideration.

Analysts generally expect euro benchmark covered bonds themselves to continue their tightening trend of 2025.

The persistently low senior unsecured spreads, as well as ongoing rating stability among both issuers and their covered bonds, are among factors cited as supportive of covered bond spreads next year by Karsten Rühlmann, senior investment analyst at LBBW.

“On the other hand, relative value valuations on the sovereign and SSA side and an expected increase in supply in these segments should, in our opinion, limit the potential for further spread tightening,” he adds. “Persistent (geo-)political and economic uncertainties could also influence emission windows,

“All in all, we expect further slight spread tightening in 2026, although this is likely to be less than in the current year.”

Meanwhile, the buyside is widely expected to be willing and able to absorb the forecast issuance.

Ted Packmohr, head of financials and covered bond research at Commerzbank, for example, highlights that coupon payments in the euro benchmark segment have doubled over the past two years and will amount to some €20bn in 2026. Adding this to the €156bn of redemptions means that benchmark payments due to investors next year, at €176bn, will be €24bn greater than this year.

At the same time, redemptions under the CBPP3 portfolio will be around €10bn lower, meaning that the amount set to be reinvested by private investors is higher.

“Although we expect euro benchmark gross supply to increase by c. €15bn in 2026,” says Packmohr, “the resulting net supply pressure on private investors will decrease by approximately €20bn compared to this year, as they will receive around €35bn more in repayments on their benchmark holdings. To absorb a gross supply of €170bn, private investors would therefore only need to provide net inflows of around €26bn.”

Taking into account also broader market dynamics, he expects robust demand to ensure that any remaining net supply pressure can be absorbed without major difficulties in the year ahead.