Barclays index adjusts weightings to address fiscal concerns

Friday, 27 January 2012

Barclays Capital has designed a new covered bond index in which country weightings based on market value are adjusted according to their respective fiscal strength, which the index provider expects will address investors’ concerns about being overly exposed to weaker sovereigns.

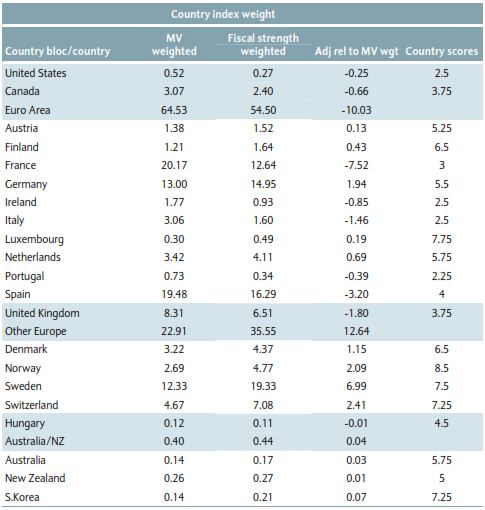

The Barclays Capital Fiscal Strength Weighted Covered Bond Index family adjusts market value weightings according to a fiscal strength score based on debt to GDP, deficit to GDP, and current account deficit to GDP ratios.

“The global covered bond market is a growing asset class, but one that still exhibits a fair amount of geographic concentration, particularly in issuers from France and Spain (c.40% by market value of the Barclays Capital Global Covered Bond Index),” said Barclays. “As a result of this concentration, some investors have sought alternative benchmarks that offer rules-based diversification to other markets while still providing a meaningful and replicable representation of the covered bond market.”

The weightings of France and Spain, for example, fall from 20.17% and 19.48%, respectively, in Barclays’ market value weighted Global index to 12.64% and 16.29%, because the two countries have relatively low fiscal strength scores of 3 and 4. In contrast, Norway has the highest fiscal strength score, at 8.5, and its weighting rises from 2.69% to 4.77%, or an increase of 77%.

The weighting of Germany, with the third largest share and a fiscal score of 5.5, increases from 13% to 14.95%. The US, Ireland and Italy have the lowest country scores, at 2.5.

Barclays analysed the returns of the unadjusted and adjusted indices between 2006 and 2011 and found that on a hedged basis the fiscally adjusted index achieved higher returns every years except 2009.

Barclays’ Global Covered Bond index: 2012 country weights within market value and fiscal strength weighted indices

Note: data as of December month-end 2011. Source: Barclays Capital