Pick-up key to NordLB aircraft prospects, Moody’s restricts uplift

An inaugural aircraft covered bond to be issued by NordLB is set to be rated one notch higher than the issuer by Moody’s, which yesterday (Wednesday) assigned a provisional A2 rating to what it expects to be a Eu500m debut. Strong demand for Pfandbriefe is seen helping the introduction of a new product at a time of heightened risk aversion, with more precise insight into appetite to be gleaned from a roadshow next week.

Germany’s covered bond legislation has permitted Pfandbriefe backed by aircraft financing since 2009 and while NordLB’s plans with regard to the asset class have been known for some time, the launch of a Flugzeugpfandbrief has become a more concrete prospect since the issuer announced that it will next week go on a roadshow, having mandated Commerzbank, Deutsche Bank, NordLB, RBS and UniCredit.

Analysts at RBS said that the prospective issue is likely to appeal to accounts searching for higher yields.

“The increasing divergence between covered bond spreads out of core markets and the European periphery means investors have fewer and fewer investment alternatives with Pfandbriefe and Scandinavian covered bonds trading at yields below 2.5% at the long end of the curve,” they said. “Against this backdrop, the asset class of Aircraft Pfandbriefe – offering most likely a pick-up versus other Pfandbrief products – are likely to attract good demand in this environment.”

Michael Schulz, head of fixed income at NordLB, said that investors are very selective given the prevailing market sentiment, deterring second tier issuers from tapping the market. Introducing a new type of covered bond would normally be very challenging in such a market environment, he said, and the pending debut of an aircraft Pfandbrief is mainly due to the high esteem in which Pfandbriefe are held.

Some market participants believe aircraft covered bonds are unlikely to be more than a niche product, citing relatively limited outstanding aircraft refinancing volumes among issuers and aircraft finance’s sensitivity to economic developments. A fund manager said that cyclical risk and concerns about the granularity of the cover pool are likely to mean that he will not get involved in the asset class.

According to the Association of German Pfandbrief Banks (vdp) the long term prospects for the German aircraft finance market are favourable, with some Eu44bn in additional lending commitments set to be posted annually up to 2013.

Pricing will be key to the level of appetite for NordLB’s offering, said a syndicate official, noting that although the investor base for the product is likely to be limited the asset class is still an attractive investment alternative. With no outstanding bonds that could serve as direct references the roadshow will be a key part of the price discovery process, according to the syndicate banker.

He outlined a rough approach consisting of using secondary market levels for a Eu500m five year HSH mortgage Pfandbrief that was priced in March as a reference point, and adding a concession to come to an idea about possible pricing of a NordLB aircraft Pfandbrief.

“That might get investors’ interest,” he said.

HSH’s 2017s were priced at 33bp over mid-swaps, and are trading in the low 20s, according to the syndicate official.

“The pricing is tricky,” he said. “It’s a new instrument and to get off to a good start you would think it has to come with an attractive spread.”

Moody’s has assigned a provisional A2 rating to the Flugzeugpfandbriefe, a one notch uplift from the issuer’s rating. The rating agency said that the uplift is restricted to one notch because of the high level of losses it expects following an issuer default and the lack of relevant historical data available to study collateral losses of aircraft financings.

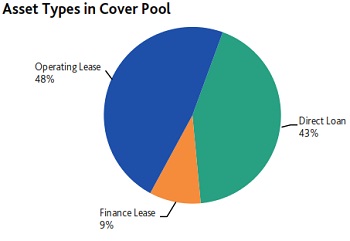

As at 30 April the cover pool backing the bonds comprised Eu950m of assets (74 financings), the vast majority of which are aircraft loans – 43% of the pool is made up of direct loans to airlines, 48% of aircraft operating leases and 9% of aircraft finance leases. All financings are backed by aircraft mortgages.

Moody’s has modelled the level of losses in a stressed scenario and considers that these would amount to 72.9%. Collateral risk accounts the most for the expected losses, at 67%, with market risk estimated at 5.9%. Collateral risk is derived from the collateral score, which is 100% for the programme. It represents Moody’s opinion of how much credit enhancement is needed to protect against the credit deterioration of assets in the cover pool in order to reach a theoretical triple-A expected loss, assuming those assets are otherwise unsupported. The rating agency said that the collateral score is set at 100% due to, in its own words:

- the historic evidence that aircraft market values are exposed to more frequent and higher volatility than conventional Pfandbrief collateral (like residential mortgages), which is triggered by a wide range of factors and

- the limited amount of relevant historical data available to study collateral losses of aircraft financings, especially following issuer failure, which does not enable us at this stage to determine how much credit enhancement is needed to protect against the credit deterioration of assets in a cover pool in order to reach a theoretical Aaa expected loss.

However, Moody’s has given some credit to the cover pool, with the one notch uplift reflecting the strength of the legal framework for Flugzeugpfandbriefe, such as a 60% LTV threshold based on the aircraft lending value, and the role of the issuer in the programme. The rating agency also noted that it has updated its assessment of non-EEA assets in Pfandbrief cover pools and that it is as a result giving full value to the US assets in NordLB’s cover pool, which at the outset accounted for 24% of collateral. (See separate article for more.)

The first series to be issued is expected to be for Eu500m, according to Moody’s, which in combination with a cover pool of Eu950m means that overcollateralisation at closing stood at 87% on a nominal basis, although the rating agency in its expected loss analysis did not rely on OC beyond 2% provided on a committed basis.

Moody’s has assigned a Timely Payment Indicator (TPI) of “improbable” to the covered bonds.

Source: Moody’s. Percent share of total aircraft financings in the cover pool.