Fitch warns of addiction but says modest use not abuse

Thursday, 10 March 2011

Fitch acknowledged that covered bond funding could be “more of a curse than a choice” in extreme scenarios in a report today (Thursday), but said that their use is not a risk for many banking groups and that regulators are “not blindly encouraging issuance”.

Record volumes of covered bond issuance this year, with around Eu80bn of benchmarks sold so far this year, have raised concerns about structural subordination of unsecured creditors, while fears over the impact of bail-in legislation have stymied demand for senior unsecured debt.

Fitch said in its report, “Banks’ use of covered bond funding on the rise”, that it will deal with the impact of covered bond issuance on the creditworthiness of senior unsecured issuance at a later date, but highlighted the pros and cons of covered bond issuance for banks and their creditors.

“The increase in covered bonds funding is compounded by the over-proportional increase in the size of the cover pool assets, which collateralise the bonds,” said the rating agency. “Issuers now provide larger overcollateralisation than in the past to protect investors against credit and market value risks. This reduces the assets available to enable repayment of unsecured debt and depositors in the event of an issuer default. Furthermore, covered bonds are not the only form of secured funding encumbering assets on banks’ balance sheets. There is also an increased use of collateral for central bank funding and market repo activity.

“However, Fitch notes that access to alternative, low-cost funding sources and especially long-term ones is beneficial to a bank’s creditworthiness and, by extension, to its unsecured creditors.”

The rating agency said that while these dynamics may be unhelpful in aggravated circumstances, they are not in most cases a cause for concern.

“There is an argument that a potential spiralling effect exists, whereby growing covered bond funding could gradually crowd out appetite for senior unsecured debt,” said Fitch. “Certainly, increased issuance of secured funding in a troubled bank may become more a curse than a choice for treasurers seeking investors for unsecured issues.

“Apart from such extreme cases, the risk of covered bond funding reaching a level that acts as a deterrent to potential senior unsecured debt investors is still small for the majority of issuing banks.”

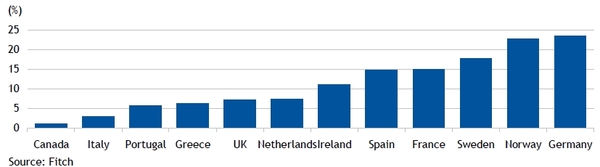

The report sheds light on the extent to which covered bonds have become a factor by looking at their issuance as a share of balance sheets by country, and revealing how many issuers have become too reliant on the source of funding (see charts).

For 17% of Fitch’s sample, covered bonds comprise between 20% and 70% of total equity plus total liabilities. These are concentrated in established markets, according to the rating agency, with only “a handful” in either the 30%-50% or 50%-70% bands – see table below for the institutions in question. Fitch also highlighted the complexities of such analyses given the different structures in each market, and relationships between covered bond issuers and associated banking groups.

Average funding reliance on covered bonds by country (covered bonds outstanding in Fitch's sample in % of total balance sheets)

Average nominal overcollateralisation was highest in Spain, at 196%, but Fitch noted that this is explained by the entire mortgage books of Spanish issuers (with the exception of bonds pledged to holders of bonos hioptecarios) being available for the prior redemption of cédulas in the event of issuer insolvency.

Increased demand for covered bonds has not only been prompted by bail-in fears surrounding senior unsecured debt, but also by regulatory support for the asset class through beneficial treatment under Basel III and Solvency II. Fitch noted this, but added that “regulatory authorities have not remained oblivious to the unintended consequences of large concentrations of covered bond funding on the safety of their banking systems”.

| Issuer or issuer group | Country | Use of covered bond funding (%) |

|---|---|---|

| Deutsche Genossenschafts-Hypothekenbank | Germany | 50-70 |

| Crédit Immobilier de France Développement (CIFD) | France | 50-70 |

| Corealcredit | Germany | 30-50 |

| Eurohypo | Germany | 30-50 |

| Duesseldorfer Hypothekenbank | Germany | 30-50 |

| KLP Banken AS Group | Norway | 30-50 |