Moody’s reviews core Dexia entities, considers hypotheses

Monday, 3 October 2011

Moody’s has put the ratings of Dexia’s main operating entities on review for downgrade on concerns about the group’s liquidity position in light of worsening market conditions, but said it will take into account comments made by the group’s chairman that it will examine “various strategic hypotheses”.

The move comes after Fitch last Tuesday downgraded Dexia’s Viability Rating from bb to b+ due to the “impact of the deteriorating operating environment on Dexia’s structural weaknesses, which mainly relate to funding and liquidity”.

The rating agencies’ actions come at a time when media outlets have been reporting on a possible split of Dexia, with one reported scenario involving shareholders La Banque Postale and Caisse des Dépôts et Consignations forming a new lender for French local authorities with Dexia as an investor. French business newspaper Les Echos previously reported that French and Belgian finance minister will discuss Dexia’s future during a meeting of euro-zone finance ministers in Luxembourg today.

However, Jean-Luc Dehaene, chairman of the board of directors of Dexia, has denied rumours of a split of the group.

According to a statement released following a meeting of the group’s board of directors on Tuesday (27 September): “Contrary to certain rumours the Board of Directors and Dexia shareholders, both public and private, exclude any scenario involving a demerger of the Group. It is the responsibility of all the shareholders to manage the heritage of the past and work to guarantee its future.”

The statement also said that the group will continue “to examine various strategic hypotheses with the aim of strengthening the financial fundamentals of the Dexia Group and to guarantee the development of its business lines”.

Royal Bank of Scotland analysts said that in their view it seems likely that Dexia Group will get “some kind of support either in the form of guarantees for debt issuance or asset guarantees”. Dexia previously issued government backed debt in a unique scheme with guarantees from its different government owners.

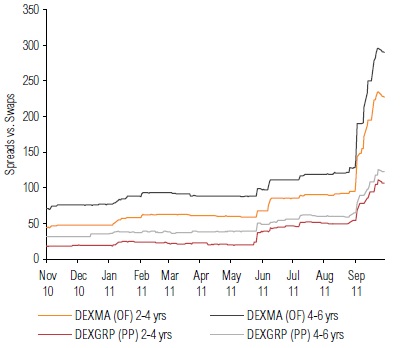

According to the RBS analysts Dexia’s covered bond spreads stabilised toward the end of last week following an “ugly” widening since the end of August, but they added that the differential between the group’s Pfandbriefe and obligations foncières across maturities remains “exceptionally wide” at 150bp-200bp (see chart below).

“We expect that Dexia spreads will remain volatile but there is a chance that the French and Belgium governments will step in at some stage,” they said.

Cristina Costa, senior covered bond analyst at Natixis, said that in her opinion Dexia group’s business model is not sustainable, and that clarity on the group’s future is needed.

“Dexia covered bond spreads will continue to widen as long as a solution is not mapped out,” she said. “The cover pools are still solid with the level of overcollateralisation above the committed and regulatory minimum, but I’m afraid the levels could decline over the medium term.”

Fitch last Tuesday affirmed the ratings of Dexia’s three core operating subsidiaries, but noted that if financial markets remain dysfunctional for a prolonged period balance sheet reduction and access to funding will become more difficult and that Dexia’s financials could be hit by problems faced by the weakest European sovereigns, especially Greece. Dexia held Eu3.8bn of Greek government bonds at the end of Q2 2011, according to Fitch, and is reliant on capital markets, which represent around 70% of its funding as at end of the second quarter, with its use of short term funding large, though decreasing.

Moody’s said today it will review for downgrade the bank financial strength ratings (BFSR), and long and short term ratings of Dexia Bank Belgium, Dexia Crédit Local, and Dexia Banque Internationale à Luxembourg.

The BFSRs are aligned at D, mapping to Ba2 on Moody’s long term scale, while the long and short term ratings are at A3 and Prime-1, respectively.

Dexia has three covered bond issuers – Dexia Municipal Agency, Dexia Kommunalbank Deutschland and Dexia LDG Banque. Obligations foncières issued by Dexia Municipal Agency are rated Aaa by Moody’s, based on a Timely Payment Indicator (TPI) of “probable-high” and the A3 rating of Dexia Crédit Local, the sponsor bank. Under Moody’s TPI methodology the combination of this TPI and an A3 sponsor bank rating means that there is no leeway for the covered bond rating to sustain a downgrade of the sponsor bank rating without it, too, being cut, all other things being equal.

Lettres de gage issued by Dexia LDG Banque and Pfandbriefe issued by Dexia Kommunalbank are rated AAA by Standard & Poor’s.

Moody’s said that the review of the BFSRs is driven by its concerns about further deterioration in the liquidity position of the group since its last rating action, on 8 July. In a press release at that time, Moody’s said that it “continued to have concerns about the group’s sizeable reliance on short term funding and the consequent liquidity gaps that render it vulnerable to adverse market conditions and to a deterioration in the market perception of the creditworthiness of Dexia, and consequently increasingly reliant on the support which the group’s shareholders have so far made available”.

The rating agency today said that in its view Dexia’s access to market funding, “even” short term unsecured funding, has tightened further. Increased collateral postings on hedging derivatives on account of substantial market volatility are also likely, according to Moody’s, to have led to a substantial increase in its usage of short term secured funding, potentially resulting in a further squeeze in the group’s available liquidity reserves.

The rating agency’s review will also involve an assessment of the potential for further support from the governments of France, Belgium and Luxembourg to offset any reduction in the group’s intrinsic strength.

The A3 rating of Dexia’s main operating entities incorporate a five notch uplift based on Moody’s expectation that the group will benefit from very high systemic support from the these countries.

Noting comments made by Dexia’s chairman on Tuesday, Moody’s also said that it will use its review to assess “the effect of any change in the Group’s strategy on (i) Dexia’s business and risk profile; and (ii) the systemic support available to the various group entities over the longer term”.

Source: RBS