Dexia in Pfandbrief buyback as public business declines

Monday, 23 April 2012

Dexia Kommunalbank Deutschland has launched a Eu3bn public sector Pfandbrief buyback aimed at “fine-tuning” its redemption profile given a lack of new public sector financing business, while Berlin Hyp faced a first rating action after announcing a tender offer last week.

Berlin-Hannoversche Hypothekenbank on Thursday said it would be buying back public sector Pfandbriefe and lowering their overcollateralisation to better support the bank’s main refinancing instrument, mortgage Pfandbriefe, and Fitch put the public sector Pfandbriefe on Rating Watch Negative on Friday (see below for more).

Dexia Kommunalbank’s and Berlin Hyp’s moves come as the issuers retreat from public sector financing lending, a development cited by each in the rationale for the tender offers. RBS analysts said Berlin Hyp’s move was an example of the strongly diminishing role of public sector covered bonds as a funding instrument for banks, not least in Germany, while another covered bond analyst said other German banks are considering similar moves.

At a press conference on the same day Berlin Hyp announced its move, the Association of German Pfandbrief Banks (vdp) noted the continued shift from public sector to mortgage sector business among its members, with gross issuance of public sector Pfandbriefe having fallen 25.5% in 2011.

Dexia Kommunalbank is targeting a buyback of up to Eu3bn across 10 Pfandbriefe totalling Eu10.065bn that mature between February 2013 and May 2018, and has set a cap of Eu3bn, although this can be modified. If the tendered bonds exceed the maximum the issuer will repurchase them on a pro-rata basis.

The tender offer’s main goal, according to the issuer, is to smooth its liability profile, against a backdrop of limited refinancing needs. Jérôme Gyss, director, fixed income investor relations at Dexia, told The Covered Bond Report that it is aimed at fine-tuning the issuer’s redemption curve given that Dexia is originating very little new business.

“We are taking the opportunity to also open a window for investors if they want to turn over their bonds,” he added.

Gyss cited as other benefits, though not the main drivers, of the transaction as being an improved asset-liability mix, and the freeing up of assets that would otherwise be tied up as collateral.

Dexia Kommunalbank Pfandbriefe are rated AA+ by Standard & Poor’s, on CreditWatch negative. The rating agency cut the covered bonds to this level on 5 April after downgrading Dexia Crédit Local, and said that the public sector Pfandbriefe could be downgraded by up to two notches if “a difference between the available and target credit enhancement” is not remedied. S&P considers the Pfandbriefe to have “low” asset-liability mismatch risk.

The Pfandbrief tender offer is Dexia group’s second covered bond liability management exercise in just over a year-and-a-half, after Dexia Municipal Agency in September 2010 launched an exchange offer for Eu14.5bn of obligations foncières.

Commerzbank and Deutsche Bank are joint dealer managers for the new tender offer.

The repurchase spreads range from 5bp over mid-swaps for a 5.25% February 2013 issue to 65bp over for 4.75% paper due May 2018 (full details below).

A banker close to the tender offer said that the targeted bonds do not trade frequently and that it is therefore difficult to state the premium over market prices on offer, but said that the tender spreads are attractive while offering value to Dexia.

A syndicate banker away from the buyback said that the purchase spreads on the longer dated Pfandbriefe were 50bp-60bp inside secondary mid levels.

“They ought to get traction at those levels,” he said.

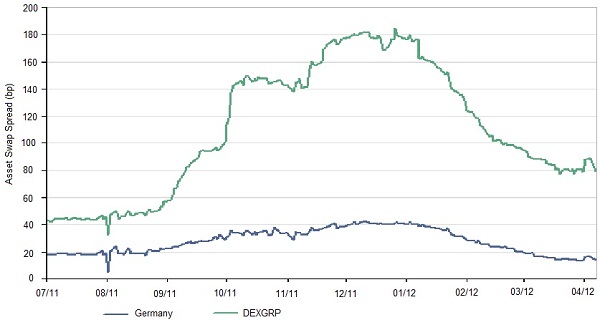

NordLB covered bond analysts said that the tender offer appears attractive for investors given the continued uncertainty over Dexia Kommunalbank’s future, and that the purchase spreads are in some instances considerably tighter than screen quotes (see table and chart).

While Dexia Municipal Agency is being taken over by a new credit institution that will be part owned by the French state in addition to Caisse des Dépôts et Consignations, Dexia Crédit Local, and La Banque Postale, the fate of Dexia Kommunalbank is understood to remain unclear.

The issuer had Eu32.75bn of public sector Pfandbriefe outstanding as at 31 December 2011.

Fitch put Berlin Hyp’s public sector Pfandbriefe on Rating Watch Negative on Friday after the German bank’s announcement that it would not be maintaining overcollateralisation necessary to retain triple-A ratings from Fitch and Moody’s, but would follow the requirements of the German Pfandbrief Act, which requires 2% minimum overcollateralisation, and an additional buffer (see article here).

“Normally, Fitch bases its analysis on a level of OC which has either been committed by the issuer or if the issuer is rated at least ‘F2′’, on the lowest level of OC observed in the preceding 12 months as long as the issuer intends to maintain a relatively stable level of OC,” said Fitch. “Since the issuer has stated that the level of OC will be reduced, Fitch can no longer rely on the lowest level of OC observed in the preceding 12 months.

“Therefore, the agency will review the programme in due course.”

A covered bond analyst said that Berlin Hyp had acted responsibly in combining the OC move and buyback.

“BHH recognises that despite the rating being only one factor used when determining the value of a Pfandbrief, some investors might be rating sensitive for individual or technical reasons,” he said. “Therefore, BHH is acting proactively in providing these investors the opportunity to close the positions – under admittedly quite favourable positions.”

| Series | ISIN | Volume (Eu m) | Purchase spread (bp) | Screen spread |

|---|---|---|---|---|

| 5.25% Feb 2013 | DE0001016822 | 665 | m/s + 5bp | 37 |

| 1.875% Mar 2013 (Jumbo) | DE000DXA1M21 | 1000 | m/s + 5bp | 19 |

| 1.625% Oct 2013 (Jumbo) | DE000DXA1NB5 | 1000 | m/s + 15bp | 50 |

| 2.75% May 2014 (Jumbo) | DE000DXA1NP5 | 1000 | m/s + 45bp | 79 |

| 3.50% Jun 2014 (Jumbo) | DE000DXA1ME1 | 1500 | m/s + 50bp | 73 |

| 2.00% Jun 2014 | DE000DXA1M88 | 500 | m/s + 50bp | 81 |

| 2.50% Apr 2015 | DE000DXA1M62 | 500 | m/s + 55bp | 93 |

| 2.75% Jan 2016 (Jumbo) | DE000DXA1NH2 | 1000 | m/s + 55bp | 89 |

| 3.375% Jan 2017 (Jumbo) | DE000DXA1MV5 | 1250 | m/s + 65bp | 98 |

| 4.75% May 2018 | DE000DXA1LK0 | 1650 | m/s + 65bp | 116 |

Source: DKD, Bloomberg, NordLB, The Covered Bond Report

Dexia Kommunalbank spread development