EZ crisis ups public sector Pfandbrief substitution risk, says Moody’s

Thursday, 5 April 2012

Asset selection risk has increased for public sector Pfandbriefe as a result of sovereign downgrades, Moody’s said yesterday (Wednesday), with these covered bonds more exposed to substitution risk than before the crisis, even if most issuers have been prudent.

The rating agency noted that before the euro-area crisis, all public sector assets eligible for cover pools were originated in countries that had investment grade ratings. But after the sovereign downgrades that followed the euro-zone crisis, public sector assets originated in countries that have low sub-investment grade ratings remain eligible for cover pools, it said.

As a result of the sovereign debt crisis, in particular the downgrade of Greece to C, eligible assets for public sector Pfandbrief cover pools are rated from Aaa to C, according to Moody’s.

“We believe that the decision of which asset types the issuer decides to add or to remove from its cover pool now has a more material effect on the credit quality of the cover pool,” said Martin Rast, vice president and senior analyst at Moody’s. “This implies that public sector covered bonds are, and could become, more exposed to substitution risk than was the case pre-crisis.”

Moody’s said that over the last couple of years most issuers have been prudent with the assets they have selected for cover pools, noting that on average, the credit exposure of public sector Pfandbriefe to the euro-area periphery fell, from a peak of 8.9% in 2009 to 7% at the end of 2011. For example, it said, by the end of 2011, Greek assets had been almost completely removed from cover pools.

Moody’s said that over the last couple of years most issuers have been prudent with the assets they have selected for cover pools, noting that on average, the credit exposure of public sector Pfandbriefe to the euro-area periphery fell, from a peak of 8.9% in 2009 to 7% at the end of 2011. For example, it said, by the end of 2011, Greek assets had been almost completely removed from cover pools.

“Moody’s believes that this reinforces the general picture of issuers providing active support to their covered bond programmes,” it said.

The rating agency noted that Pfandbrief issuers retain a large amount of discretion to manage the cover pool under the Pfandbrief legislation, and that despite this flexibility the focus in German public sector Pfandbrief pools remains on German borrowers, with the average exposure at 84% as of end-December 2011, ranging from 48% to 100% across individual programmes.

Five of 36 issuers had only German assets in their pool at this time.

And although exposure to European peripheral countries is on average limited and has on average declined since December 2009, over recent years the exposures to some particular periphery countries has actually increased, according to Moody’s.

For example, between 31 December 2010 and end-December 2011, DekaBank quadrupled its exposure to Italian borrowers, whilst other issuers, including CorealCredit, Sparkasse KoelnBonn and WestLB, introduced new assets from some euro area countries, said Moody’s, although it said that the fourfold increase in the case of DekaBank and the changes at Sparkasse KoelnBonn and WestLB are not particularly relevant given that the overall remaining exposure remains low.

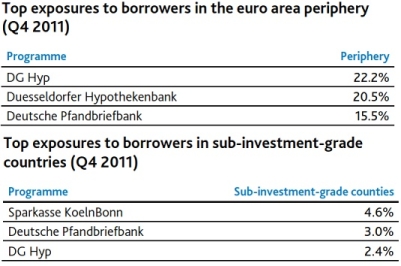

The rating agency also noted that in a few programmes the overall level of exposure to assets in sub-investment-grade countries has increased, and some pools had a weighted exposure to EU peripheral borrowers of up to 22.2%.