S&P junks Spanish trio amid turmoil, Moody’s sees fillip

Monday, 28 May 2012

S&P cut three Spanish banks to below investment grade on Friday including Bankia, whose latest troubles have contributed to a renewed weakening of Bonos. Moody’s has meanwhile said that a government backed syndicated credit facility will benefit cédulas territoriales.

S&P cut five Spanish financial institutions in total because it considers that the economic risk of the country’s banking industry adversely affects the capital positions of four of them and the business model of another.

Bankinter, Banco Popular Español and Bankia were cut from BBB- to BB+. S&P also downgraded Banco Financiero y de Ahorros, from BB- to B+ and Banca Cívica, from BB+ to BB.

Bankinter, Banco Popular Español and Bankia were cut from BBB- to BB+. S&P also downgraded Banco Financiero y de Ahorros, from BB- to B+ and Banca Cívica, from BB+ to BB.

The yield on Spanish government debt increased by some 20bp-25bp early this morning before settling around 15bp higher, while the spread over German Bunds hit a record high, reaching 505bp over, according to syndicate officials. One said that any movements in cédulas spreads are difficult to attribute to specific rating actions as these “get lost in the wash” of broader reactions to the government’s rescue of Bankia.

S&P cut their ratings after lowering its assessment of their standalone credit profiles (SACPs), which in turn followed a revision of the economic risk score for Spain from 5 to 6, and a two notch downgrade of Spain to BBB+ on 26 April.

“We revised the SACPs following our review of the Spanish banking industry’s economic risk, owing to the impact we see on the capital positions of the first four institutions and on the business model of the fifth one,” said the rating agency. “As a result of our calculations, the capital positions of the institutions are immediately affected by a revision of the economic risk score.”

S&P is for the first time incorporating into the long term ratings of two financial institutions – Banco Popular and Bankia, and indirectly Bankia’s parent BFA – one and two notches, respectively, of uplift above their SACPs to reflect its belief that the Spanish government would likely provide short term support to back any potential capital shortfall at these two institutions if necessary.

Bankia and its parent BFA remain on CreditWatch negative to reflect uncertainties surrounding Bankia’s restructuring and recapitalisation plan, and the implementation risks this may entail.

S&P also on Friday affirmed the ratings of nine Spain-based financial institutions and maintained the ratings of five on CreditWatch with negative implications. With the exception of Confederación Española de Cajas de Ahorros and Banca Cívica, the ratings either carry a negative outlook or remain on CreditWatch negative.

Twenty-six Spanish banks, savings banks and rural cooperatives on 16 May formalised a syndicated credit facility to provide loans to the Fund for the Financing of Payments to Suppliers (FFPP), and Moody’s today said that the facility, which will be guaranteed by the Spanish government, is credit positive for Spanish public sector covered bonds (cédulas territoriales, CTs).

The facility is for Eu30bn and has the sole purpose of repaying commercial debt accumulated by Spanish regional and local governments (RLG). A royal decree creating the FFPP treats it as a public entity, as a result of which loans to FFPP will automatically become eligible collateral for CTs under the Spanish public sector covered bonds framework, according to Gaston Wieber, analyst, Moody’s.

He said that the credit quality of public sector cover pools will improve by the addition of such loans by participating banks, because loans guaranteed by Spain are generally less risky than RLG debt.

“Most public sector cover pools are concentrated in RLG debt and have little or no exposure to the government of Spain,” he said. “The CTs’ exposure to the government of Spain will substantially increase because loans to FFPP benefit from a sovereign guarantee.”

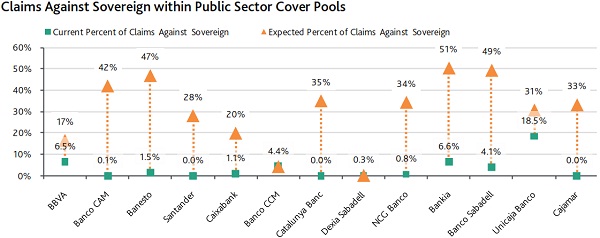

The chart below shows the expected cover pool exposure to the government of Spain after participating in the syndicated credit, compared with the prevailing levels.

The credit facility also increases the amount of assets in cover pools – by Eu20bn in total – with some issuers’ cover pools almost doubling, according to Wieber, assuming full use of the FFPP in 2012.

“It is hard to know exactly how this increase will translate into overcollateralisation because banks can issue additional CTs, although banks usually maintain overcollateralisation levels much higher than the one required by law,” he said.

Moody’s excluded Eu10bn of credit from its analysis because Eu7bn is to be provided by Instituto de Crédito Oficial and entities that currently do not have outstanding CTs, or which Moody’s does not rate, financing around Eu3bn.

Source: Moody’s