Fitch sees ‘Viking’ funding as benign, Danish view at odds with Moody’s

Thursday, 21 June 2012

A reliance on wholesale funding by Nordic banks is not a major threat to their credit quality, according to Fitch, which said yesterday that a deep and efficient covered bond market in Denmark in particular reduces funding risk – a view that contrasts sharply with Moody’s.

Moody’s cited Danish reliance on wholesale funding in general and covered bonds in particular as a driver in its decision to cut the ratings of several of the country’s financial institutions on 30 May, although it had a few days earlier seen covered bond funding as positive when delivering rating actions on Norwegian and Swedish banks.

Fitch said yesterday (Wednesday) that the reliance on wholesale funding of large Nordic banks reflects a structural shortage of deposits driven by households’ preferences for pension and investment products in Scandinavia, and to a lesser extent Finland.

“Too great a reliance on wholesale funding has contributed to bank failures across the globe during the current crisis,” it said. “But we believe it would be incorrect to view Nordic wholesale funding in the same light.”

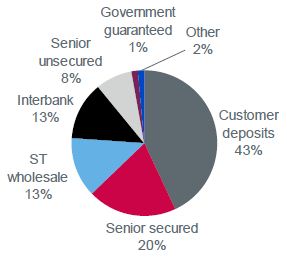

According to Fitch, the banks in question fund roughly half their assets with customer deposits and half through the domestic and international interbank and debt capital markets.

“These banks benefit from the recycling of retail savings which are driven by tax incentives and a culture of financial investment to domestic pension funds and insurance companies,” it said. “These institutional investors, as well as domestic financial institutions, need to invest in local currency assets to match their liabilities.

“The relatively low level of government bonds in Scandinavia leaves bank paper as one of a few investment options.”

Non-equity funding

Source: Bloomberg, banks’ annual reports, data adjusted by Fitch

The rating agency also noted that Nordic banks are reliant on international investors to varying degrees, and that market sentiment towards them has remained generally positive.

Fitch said that it sees deep and efficient covered bond markets in Sweden and Denmark as further reducing refinancing risk.

“Danish mortgage bonds, in particular, have a very long history and no default,” said the rating agency. “In Norway, the covered bond product is relatively recent but has taken off well.

“Issuance of covered bonds in Finland has remained modest.”

Fitch discussed the issues on a “Viking Tour” last week taking in Oslo, Stockholm, Copenhagen and Helsinki, where they also asked 250 credit market participants’ views on encumbrance, which Fitch said was in greater focus given high levels of covered bond issuance. While 29% of respondents considered the issue largely irrelevant, 30% were concerned about encumbrance levels of 10%-30%, 24% at levels of 30%-50%, and 17% at over 50%. The rating agency said that, at current levels, senior unsecured debt ratings of major Nordic banks are not negatively affected by structural subordination.

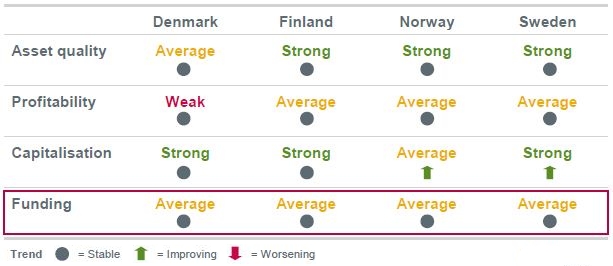

Source: Fitch