No return to AAA or AA for multi-cédulas, says Fitch

Friday, 27 July 2012

Fitch will no longer assign AAA or AA ratings to multi-cédulas using current structures, it said in an update to its criteria today (Friday), even if Spanish collateral and bank credit quality improves. Its update included changes to address the risk of unexpected reductions in OC.

Spanish multi-issuer cédulas hipotecarias (MICH) carried triple-A ratings when they grew into one of the biggest sectors of the covered bond market before the financial crisis, but have since been downgraded below double-A by Fitch, especially in light of Spain’s recent plight.

However, under Fitch’s stance the covered bonds – whereby Spanish financial institutions, mainly savings banks (cajas), pool cédulas hipotecarias – will not in their current format return to either the triple-A or double-A ratings categories even if there is a dramatic improvement in the collateral backing the issuance or in the credit quality of the financial institutions participating in the transactions.

“Fitch would no longer assign AAsf or AAAsf category ratings to transactions using current structures because of their weakness in protecting against the credit quality migration of the CH portfolio,” said the rating agency. “This weakness is the consequence of the lack of structural isolation from CH issuers.

“For example, decisions by CH issuers to have their ratings withdrawn, not to commit to minimum OC levels or to reduce their OC levels have negatively affected the credit profile of their CHs. This caused deterioration of the credit quality of the CH portfolios of MICH transactions, which ultimately resulted in downgrades of MICH ratings.”

The rating agency’s stance does not, however, preclude new structures being designed that would overcome these obstacles to Fitch’s top ratings.

In its criteria update, Fitch said it had made only two significant changes. The rating agency said that otherwise the update amounted to a complete rewrite of its criteria to improve clarity and that it will have no impact on MICH ratings.

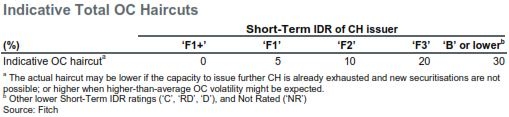

“The two most significant changes are that Fitch will apply haircuts to overcollateralisation of CH [cédulas hipotecarias] issuers as a function of their short term rating to address the cliff effect at the former ‘F2’ threshold,” said the rating agency. The agency has also updated the formula for estimating the present value of the mortgage-covered pool under stress to account for higher rating stresses.

“Fitch has also clearly indicated the minimum data needed to maintain the ratings and the frequency of updates. The report contains links to the Excel template files that should be used for reporting monthly and quarterly data sets.”

Under the new OC criteria, Fitch will generally apply haircuts of between 5% and 30% for issuers with short term issuer default ratings (IDRs) in categories ranging from F1 to B or lower (see table).

“Fitch believes the risk that existing OC cushions are reduced unexpectedly becomes more pronounced as a financial institution’s credit profile weakens,” it said. “This is because OC cushions are dynamic and may decline if the CH issuer allows its mortgage book to run off, issues mortgage-backed securitisations and/or decides to increase its outstanding CH balance.

“The agency takes the short term issuer default rating of the CH issuer as the indicator of the flexibility of the CH issuer to opt for funding alternatives that would not damage the current level of OC. All else being equal, a lower short term IDR generally implies less funding alternatives and the requirement to encumber more assets.”