UK encumbrance stable despite ‘arms race’ warnings, covered downplayed

Encumbrance levels for major UK banks remained broadly stable from 2010 to 2011, according to a Financial Services Authority survey, despite recent warnings from a Bank of England official about a potential “arms race spiral” in secured financing.

The FSA data on encumbrance levels was quoted in the Bank of England’s latest Financial Stability Report, released on Friday. The FSA figures come from a second survey of major UK banks.

The FSA data on encumbrance levels was quoted in the Bank of England’s latest Financial Stability Report, released on Friday. The FSA figures come from a second survey of major UK banks.

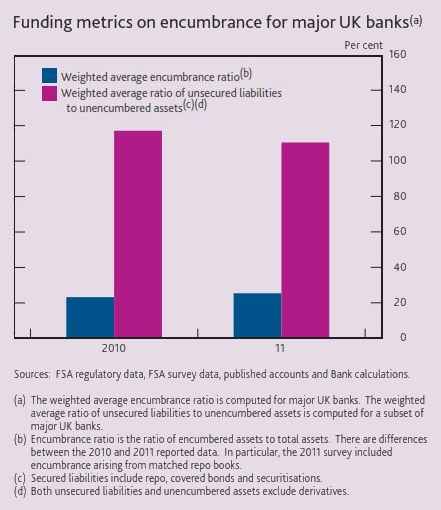

A weighted average encumbrance ratio (encumbered assets to total assets) rose from 23.19 in 2010 to 25.37 in 2011, while a weighted average ratio of unsecured liabilities to unencumbered assets fell from 117.01 to 110.40.

The Bank of England noted that the data indicated that the weighted average encumbrance ratio had remained broadly stable from 2010 to 2011.

“The strong covered bond issuance witnessed over the period had an increasing effect on reported encumbrance levels,” said the central bank. “But this was offset by other factors such as the winding down of the Bank’s Special Liquidity Scheme.

“The ratio of unsecured liabilities to unencumbered assets decreased slightly. Assuming uniform asset quality, this indicates that banks’ assets available in resolution have increased slightly.”

The Bank noted two important caveats: that providing data was “challenging for banks” and “many returns were hard to validate”; and that there were inconsistencies between the two surveys, with encumbrance arising from matched repo books, for example, being included in the 2011 survey.

“These caveats suggest that banks need to improve the timeliness and consistency of their data relating to encumbrance as a means of improving risk management of their balance sheets,” said the Bank.

It also said that estimates from other sources put encumbrance levels for the major UK banks at around 19%, below the FSA’s figure. This finding backs up comments made in April by Andrew Haldane, executive director, financial stability, at the Bank, when he said that data on banks’ encumbrance levels are “thin on the ground” and “rarely on a consistent basis”.

Haldane’s comments came in a speech where he discussed “Financial Arms Races”, taking in the issue of encumbrance.

“Consider an unsecured creditor about to refinance,” he said. “The larger the existing fraction of secured financing, and the greater the uncertainty about this fraction, the greater will be their incentive to seek security…”

“The greater the level of, and risk around, encumbrance levels, the higher the return unsecured creditors will demand given the risks of subordination. And the higher this cost, the greater banks’ incentives to finance instead on secured terms.”

In the Financial Stability Report the Bank also played down covered bonds’ perceived role in the encumbrance debate.

“Outside estimates of encumbrance have sometimes focused on covered bonds, partly because information on them is more straightforward to obtain,” it said. “But there are other types of bank activities, including derivatives, that encumber assets and covered bonds are not necessarily the most significant secured funding source for UK banks.”