Top prelim ratings for new CA ECA OF programme

Monday, 3 September 2012

Moody’s and Standard & Poor’s on Friday assigned preliminary triple-A ratings to obligations foncières due to be issued by Crédit Agricole Public Sector SCF, which S&P said is expected to make its debut this month with a Eu1bn deal that could feature a five to seven year maturity.

The société de credit foncier (SCF) was set up last year, and is the French bank’s second covered bond issuer, alongside Crédit Agricole Home Loan SFH, which issues legislative mortgage backed covered bonds.

Obligations foncières issued by Crédit Agricole Public Sector SCF will be backed by a cover pool initially including loans featuring a loan guarantee or insurance policy provided by an export credit agency (ECA), supported by France, Germany, or the UK, according to Moody’s. Moody’s rates the governments backing these export credit agencies Aaa, while S&P said that it rates the sovereigns backing the ECA-guaranteed loans AA+ or AAA.

Moody’s has assigned a Timely Payment Indicator (TPI) of “probable-high” to the covered bonds, which provides for a TPI leeway of one notch. The collateral score for the initial cover pool is 0% because of the Aaa rating of the sovereigns backing the ECAs guaranteeing the assets in the pool, said Moody’s, which estimates cover pool losses of 11.6% if Crédit Agricole (rated A2) defaults.

Standard & Poor’s said that the Crédit Agricole SCF’s set-up and the cover pool’s asset composition is similar to other French public sector covered bonds, and that it has therefore assigned the programme to Category 1 under its framework classification.

It said that the first obligations foncières under the SCF programme are expected to be launched in September with a maturity of five to seven years (subject to change) and to equal Eu1bn.

The covered bonds will feature “low” asset-liability mismatch (ALMM) after the first issue, it added. Together with the Category 1 programme classification this means the obligations foncières can be rated up to seven notches above the issuer credit rating (ICR) of Crédit Agricole.

After the first issue an available credit enhancement of 38.51% will exceed the target credit enhancement, added S&P, which therefore considers the maximum achievable rating on the covered bonds to be AAA. This represents five notches of uplift from Crédit Agricole’s ICR of A.

As of 30 June the cover pool comprised Eu1.5bn of assets out of a total balance of Eu2bn, according to S&P, with the remainder due to be included once they become eligible following completion of formalities related to the transfer of an asset. However, the rating agency said that it understands that as of 31 July the transfer formalities for two more loans to an additional borrower guaranteed by the French ECA had been completed, increasing total eligible assets to Eu1.6bn.

The main impact of the remaining assets becoming eligible for the cover pool, added S&P, will be a reduction in concentration risk. It said that the initial cover pool is relatively concentrated, with the top 20 borrower-guarantor couples representing 92% of the cover pool.

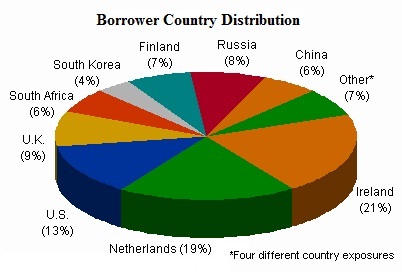

The underlying loans comprise a diversified pool of corporate borrowers, according to S&P, with a focus on aircraft finance and power generation. The rating agency noted that there is a concentrated exposure to aircraft financing loans, with the country exposure to Ireland in particular essentially consisting of aircraft leases domiciled in Ireland.

“The remainder of the cover pool mainly consists of exposures to power and infrastructure companies and development banks in emerging market countries,” said S&P.

S&P’s preliminary rating is on stable outlook to reflect that the ratings of the covered bonds are not capped by the French sovereign rating.

Source: S&P