Strong bid-to-covers for RD in Danish ARM auction finale

Realkredit Danmark ended its auctions of ARM bonds on a strong note on Friday, with its sale of one, three and five year bonds also bringing to an end the latest refinancing round by Dutch mortgage banks, with some Eu25bn equivalent of Danish krone bonds sold in total.

Realkredit Danmark (RD) was the only issuer auctioning covered bonds last week, with the others having already finished. It ended up auctioning Dkr42.2bn (Eu5.66bn) of one year Danish krone adjustable rate bond (ARM) bonds, Dkr11.15bn of three year bonds and Dkr10.3bn of five year bonds. It also sold Eu525m of one year euro bonds.

In total Dkr188bn (Eu25.22bn) of Danish krone one, three and five year ARM bonds were auctioned by Danish mortgage banks, according Jacob Skinhøj, head of covered bond research at Nordea Markets. This represented around 90% of total auction volumes, he added.

RD ended its auctions on a strong note. On Friday the bid-to-cover ratios on the supply of one year, three year, and five year bonds was the highest during the issuer’s auctions, standing at 3.14, 4.37 and 6.28, respectively. The next highest bid-to-cover ratios were 3.01 for the one year bonds, on 4 March, RD’s first day of auctions, and 4.37 for the three year bonds on the first day these were auctioned, on 11 March, and 4.11 for the five year bonds, on Thursday, the day before the auctions ended.

Jan Weber Østergaard, senior analyst at Danske Bank, RD’s parent, highlighted that spreads on RD’s five year bonds tightened by 2.5bp versus three month swaps, while the one year and five year bonds tightened by 1bp.

“During the auctions, the spreads widened the first 10 days in general,” he said about RD’s bonds, “but in the last week spreads have almost tightened back to starting levels.”

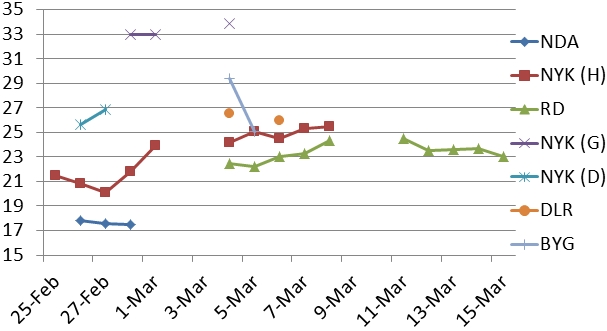

One year ARMS – April auction spreads (bp)

Source: Nordea Markets