Limited impact as France tackles ‘dramatic’ rent hikes

Tuesday, 18 September 2012

A rent control decree issued by the French government on 1 August will reduce investor appetite for buy-to-let properties and therefore dampen house prices in the sector, said Moody’s yesterday (Monday), but the credit impact on French covered bonds will be limited.

The decree is a temporary measure designed to help stabilise rents and curb surging house costs, primarily by limiting rent increases between successive tenants, according to Moody’s analysts Alix Faure and Ariel Weil.

Rents across France have risen faster than inflation, they noted, with dramatic increases in rents and purchase prices over the past few years, especially in the country’s largest cities, making the developments a major political topic. House prices have almost doubled in France since 2000, according to Moody’s, while rental costs have increased on average by 35% (in a sample of 11 French cities) to 50% (in Paris).

The decree will apply for one year, until a new comprehensive housing law is passed in 2013.

Faure and Weil note that the decree will reduce investors’ interest in buy-to-let properties and therefore prolong the time to sale and dampen house prices in this sector, with other measures such as an increase in taxes on property sales and an upcoming termination of fiscal incentives for the buy-to-let market also reducing liquidity (the incentives are due to be replaced by new, less favourable ones, however).

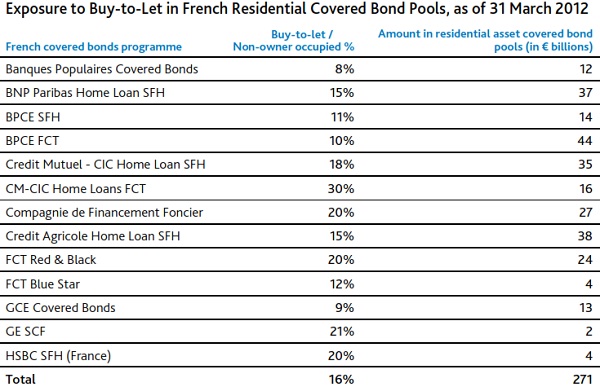

Regarding the credit impact on French RMBS and covered bonds, the analysts noted that these have less than 20% exposure to buy-to-let properties: an average proportion of loans to buy-to-let borrowers of 19% in French RMBS portfolios and 16% in French covered bond portfolios (see chart below).

“While the reduced liquidity of the buy-to-let market will drive up the loss severity in the event of a sale, it will not increase the probability of payment defaults by borrowers,” they said.

“Furthermore, amortising loans mostly finance buy-to-let properties in France, which makes borrowers less vulnerable to refinancing shock in a gloomy housing price environment.”

The analysts note that a stabilisation of rental yields at current levels for most buy-to-let owners will minimise the short term effects of the new measures, that most borrowers’ repayment schedules are based on past or current rent levels, that the decree mainly affects large cities, and that landlords can still increase rents on a par with the rental index even in the absence of any investment by owners to renovate the properties.

Source: Moody’s