Good times set to roll into 26, vdp issuance survey finds

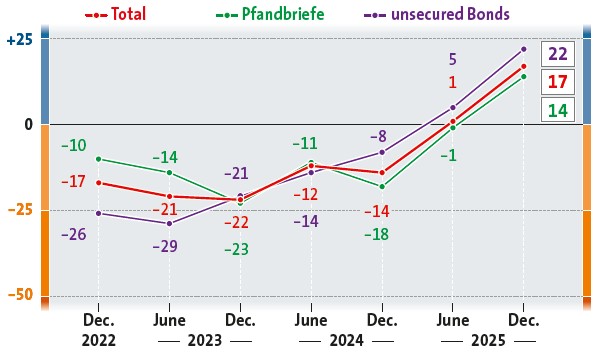

The vdp’s twice-yearly Issuance Climate survey has recorded a positive score for the outlook for Pfandbrief issuance for the first time, after market conditions proved more buoyant than expected in the second half and with overall Pfandbrief supply up 22% this year.

In the regular survey, members of the Association of German Pfandbrief Banks (vdp) assess over the past six months, the present, and coming sixth months a variety of drivers in the capital markets environment and their impact on issuance plans, and assign these a score from minus 100 to plus 100. These factors are then weighted and combined into an aggregate score for Pfandbriefe, unsecured bonds and overall issuance.

In the regular survey, members of the Association of German Pfandbrief Banks (vdp) assess over the past six months, the present, and coming sixth months a variety of drivers in the capital markets environment and their impact on issuance plans, and assign these a score from minus 100 to plus 100. These factors are then weighted and combined into an aggregate score for Pfandbriefe, unsecured bonds and overall issuance.

Pfandbriefe’s score came in at 14, up from minus 1 six months ago – the previous highest score achieved – and minus 18 a year ago. The score for senior unsecured bonds was even higher, at 22, with the overall figure 17 – both also new highs.

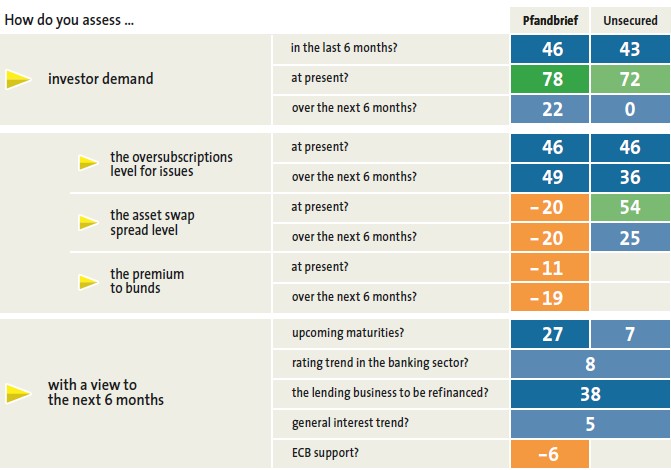

In the previous survey, conducted in June, a key sub-score – investor demand – had hit a record of 89 for present conditions for Pfandbriefe, but issuers were downbeat about the second half, forecasting minus 5 for the coming six months. However, in the current survey they scored present investor demand for Pfandbriefe at 78 and over the past six months at 46.

Sources for charts: vdp, Börsen-Zeitung; Graphic: www.igrafik.de

“It’s perhaps a little surprising quite how strong the overall sentiment has been,” Sascha Kullig, management board member at the vdp (pictured top), told The CBR. “There were so many occasions on which you could have expected a huge sentiment change in the markets, but there was always just a small dip and it didn’t take very long before risk appetite was back – which was especially reflected in the unsecured sector.

“That’s then the question for next year,” he added. “Many people say, something has to happen in the markets. Maybe our member institutions are simply a little bit cautious.”

The latter remark reflects the score of 22 for investor demand for Pfandbriefe over the next six months, an encouraging figure relative to corresponding feedback in previous surveys, but a substantial moderation versus present conditions.

Oversubscription levels are expected to remain strong for both Pfandbriefe and unsecured debt, increasing from 46 today to 49 in the first half of 2026 for Germany’s covered bonds and decreasing only slightly for unsecured bonds, from 46 to 36.

Balanced against this, the asset swap spread level and premium to Bunds of Pfandbriefe are expected to weigh on investor demand, with scores of minus 20 and minus 19, respectively, continuing in negative territory.

Investor demand for unsecured debt is also expected by vdp members to moderate, with a score of zero for the next six months, compared to positive figures of 43 for the last six months and 72 today.

“One reason for this assessment is likely to have been the narrowing of the spreads associated with the very strong demand, which could lessen the relative attractiveness for investors and so dampen demand,” said Kullig.

“On the whole, however, the strong demand for the unsecured bank bonds issued by our member banks is a reflection of our investors’ confidence in the resilience of the banks given their good earnings situation and good to very good capital adequacy levels.”

Into this year’s receptive conditions, vdp member banks issued €61.2bn of Pfandbriefe, up 22% on the previous year and well above the €50bn of issuance that had been forecast by the issuers at the turn of the year.

Benchmark Pfandbrief issuance came in at €31.4bn, compared with €29.9bn in 2024 and close to forecast, with sub-benchmark and other non-benchmark issuance, including private placements, accounting for the bulk of the increase.

Public sector Pfandbriefe made a greater than expected contribution to supply, with issuance up 73% on last year, at €21.4bn, while mortgage Pfandbrief issuance rose 7% to €39.8bn.

The vdp highlighted that around one-third of benchmark supply was in maturities of at least seven years.

“The good demand for longer dated Pfandbriefe supports the maturity-matching refinancing of long term residential property financing,” said Kullig.

Developments in vdp members’ lending business achieved the highest score in the Issuance Climate survey among factors outside demand and pricing issues, coming in at 38, up from 25 in the June edition.

“The lending business has picked up,” said Kullig, “especially with regards to residential real estate, where it has picked up quite impressively. But even in the CRE sector, lending volumes have picked up a little.”

The score for upcoming Pfandbrief maturities meanwhile swung from minus 9 to plus 27.

According to the vdp’s parallel member survey of expected issuance volumes, around €53bn of overall Pfandbrief supply is expected next year, versus around €50bn of redemptions. Some €39bn of supply is anticipated in the benchmark sector, where €30bn of maturities are due.