Moody’s sees few redress options for cédulas holders in mergers

Monday, 30 January 2012

Moody’s expects Spanish banking mergers to weaken the credit quality of the outstanding cédulas of stronger banks, and noted today (Monday) that, relative to other jurisdictions, holders of Spanish covered bonds have few options to oppose such actions even if their interests are affected.

Luis de Guindos

The rating agency referred to a statement made on Wednesday by Spain’s new economy minister, Luis de Guindos, that Spanish regulators favour restructuring the Spanish banking sector through mergers between Spanish banks.

Moody’s said that the government prefers consolidation between Spanish banks and has stated its intention to avoid further public capital injections into the banking sector, and a result of this is that weak banks will probably merge with strong banks.

José de Leon, senior vice president at Moody’s, told The Covered Bond Report that the Spanish economy minister has made clear that further consolidation is ahead, and that stronger banks are likely to merge with weaker ones.

“The Spanish banking landscape has changed dramatically over the past two years,” he said, “and consolidation may intensify, with the difference between stronger and weaker entities more substantial than it has been in the past few years.

“Some covered bond investors are worried about the impact of the mergers, and raising the legitimate question about whether there is anything they can do.”

Moody’s said that if the credit quality of the merging banks differs significantly and if the size of the weaker bank is material, the credit quality of the combined entity is usually weaker than that of the stronger bank.

“As a result, the credit quality of covered bonds of banks merging with weaker entities will usually decline, because covered bonds benefit from dual recourse to both the bank sponsor as any unsecured creditor and, in the case of default, to a cover pool,” said Moody’s.

If two banks merge their balance sheets into one, it added, the merged pool securing the covered bonds would have lower collateral credit quality than that of the stronger pool. Moody’s also said that stronger mortgage pools correlate to stronger, more creditworthy entities since real estate performance drives bank credit quality.

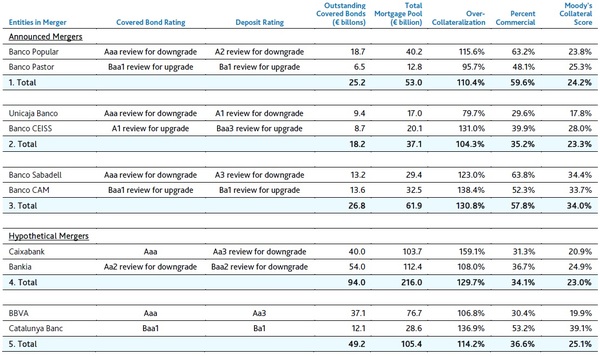

It said that key risk statistics of covered bond issuers can illustrate how the statistics of a merged cover pool are weaker than those of the stronger of the merged entities (see table below).

Moody’s said that investors in Spanish covered bonds have few legal options to oppose mergers under Spanish statutory law, which governs the terms and conditions of covered bonds.

“Spanish law for covered bonds, unlike laws for other types of bonds or other jurisdictions, does not treat the merger of a CH [cédulas hipotecarias] issuer as an early redemption event that would give investors the option of receiving their original investment in lieu of accepting a credit negative merger,” it said.

The rating agency noted that according to Article 44 of Spanish Act 3/2009 on structural changes in trading companies (such as cédulas hipotecarias issuers) within a month of the merger announcement creditors that lack sufficient security can object if the merger is detrimental to their interests. In such a case, the company cannot formalise the merger until the company presents security satisfactory to the creditor.

However, Moody’s said that proving that covered bondholders are insufficiently secured as a result of the merger is difficult because the entire mortgage book of the resulting entity acts as security for the investors in the cédulas hipotecarias.

Pro-forma key statistics of covered bonds, post-merger

Source: Moody’s, data as of end September 2011