Bernanke references covered bond push in House testimony

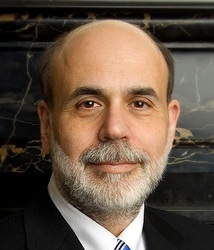

Federal Reserve chairman Ben Bernanke acknowledged initiatives to introduce US covered bond legislation yesterday (Wednesday) while testifying before the House Financial Services Committee on monetary policy and the economy.

During a discussion on private capital re-entering the mortgage lending and secondary home loans markets, Bernanke referred to covered bonds while considering the future structure of the US housing market. Congresswoman Judy Biggert (R-IL) asked the Fed chairman if the Dodd-Frank Act helps or hurts the re-entry of private capital into the market.

During a discussion on private capital re-entering the mortgage lending and secondary home loans markets, Bernanke referred to covered bonds while considering the future structure of the US housing market. Congresswoman Judy Biggert (R-IL) asked the Fed chairman if the Dodd-Frank Act helps or hurts the re-entry of private capital into the market.

“Well, I think it’s important to create more certainty and we’re not there yet,” answered Bernanke. “There has been a lot of discussion. For example, the Federal Reserve and the other agencies are still thinking about risk retention requirements and those have not been specified, so it would be helpful, I think, to get a greater clarity.

“I think it would also be good to get greater clarity about what the long run housing market structure will be. There has been plenty of discussion in this committee about GSE reform, about covered bonds, and other types of structures, but there’s still a lot of uncertainty about where that’s going to go.”

The House Financial Services Committee last June passed the United States Covered Bond Act of 2011 (HR940), which was co-sponsored by Republican Scott Garrett, who has been leading the US legislative covered bond push, and Democrat Carolyn Maloney.

“Bernanke just mentions covered bonds as a potential makeover for housing market,” tweeted Pete Schroeder (@peteschroeder), a reporter for The Hill who was covering the testimony. “Somewhere, Scott Garrett is smiling.”