S&P covered bond counterparty criteria, take two

Friday, 25 March 2011

Standard & Poor’s has issued a request for comment on new proposals to change its criteria for assessing counterparty and supporting party risk in covered bond transactions, after in January suspending application of previously announced criteria to the asset class.

The new proposals expand upon counterparty criteria for derivative obligations in certain covered bond programmes released on 6 December and updated on 13 January, while criteria relating to direct support and other support obligations remain the same as in those releases.

“Covered bonds are dual recourse in that bondholders have recourse first to the covered bond issuer and second to the cover pool assets,” said S&P. “Moreover, some covered bond programmes use multiple counterparties. In our view, these aspects justify a different treatment for assessing derivatives that contain variant structural features – as outlined in the 2010 counterparty criteria.

“The main difference between the proposed covered bond derivative criteria and the 2010 counterparty criteria is that for certain covered bond programmes, the proposed criteria link the rating on the covered bonds to both the issuer credit rating (ICR) on the covered bond issuer and on the derivative counterparty (or counterparties). The concept of counterparty replacement remains the overarching principle behind both criteria frameworks, however.”

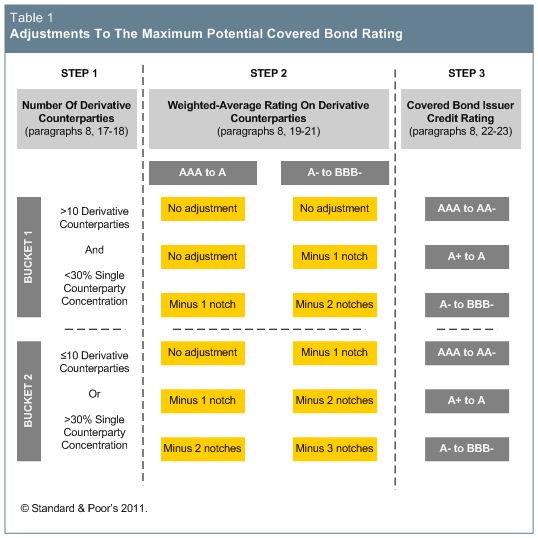

The proposed criteria consider three factors: the number of derivative counterparties; the weighted-average rating of the counterparties; and the credit rating of the covered bond issuer. These criteria, summarised in the table below, will apply when:

- The derivative obligations contain a replacement mechanism based on S&P’s 2010 counterparty criteria or earlier versions thereof;

- The derivative counterparty is not related to the covered bond issuer;

- Each derivative counterparty has an issuer credit rating of at least BBB-;

- The issuer has a credit rating of at least BBB-; and

- The maximum potential covered bond rating is linked to the covered bond issuer’s rating following S&P’s assessment of asset-liability mismatch (ALMM) risk.

“The proposed criteria would apply an adjustment of zero to three notches downward to the maximum potential covered bond rating, as determined by the 2009 ALMM criteria,” said S&P. “The proposed criteria would have a rating floor that is the higher of the covered bond issuer’s ICR plus one notch or the lowest rated counterparty’s ICR plus one notch, to the extent that we consider credit enhancement to be sufficient to support that rating, according to the 2009 ALMM criteria.

“In our view, derivative counterparty risk may be mitigated by both the covered bond issuer’s obligation to repay the bonds and the counterparty’s commitment to pay under the derivative obligations, if that counterparty is different from the covered bond issuer. Furthermore, given the importance of covered bond funding to an issuer’s overall funding strategy, in our view, issuers are motivated to manage their programs to maintain access to this funding.”

S&P is seeking responses to its proposals by 4 May.