Scandi, German supply seen as best bets for next week

Benchmark euro covered bond activity is expected next week after UniCredit on Tuesday launched the first such supply in three weeks, with Norwegian and German issuance seen as the most likely to emerge and find strong demand.

A Norwegian benchmark is rumoured and would be the first deal from the country since Terra BoligKreditt issued a Eu650m seven year issue at 55bp over mid-swaps on 12 June. Syndicate officials said that any supply from the region should go well.

A Norwegian benchmark is rumoured and would be the first deal from the country since Terra BoligKreditt issued a Eu650m seven year issue at 55bp over mid-swaps on 12 June. Syndicate officials said that any supply from the region should go well.

“I don’t think the Scandinavian issuers as such are facing any difficulties at the moment – except for allocations, perhaps,” said one. “For the top ones like Nordea, DNB and OP, we are talking about something in the mid-teens for five years. And I hear that in private placements they are getting away with single-digit spreads.

“Everything has been moving tighter given this amazing balance between supply and demand.”

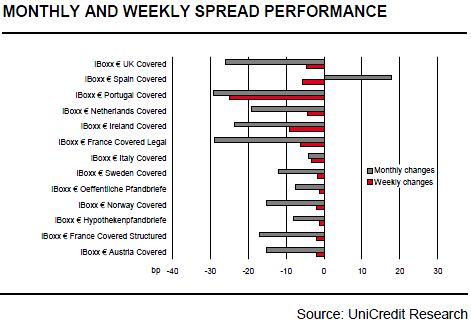

UniCredit analysts noted that since a peak on 25 May, spreads have experienced their most pronounced tightening wave since a “gold rush” in the first and quarters of 2009 driven by the first European covered bond purchase programme.

“Even the already rich segments such as French SFHs, Nordic and German paper were able to reduce the average spread level by around 50%,” they said.

German issuers are considered the other most likely candidates for issuance.

“It looks like we are going to see some German Pfandbriefe,” said another syndicate official. “Indeed I would not understand it if one or the other of them did not tap the market.”

Supply from France is also seen as a possibility, although the outlook was said to be less clear for French names.

The chances of a follow-up from a peripheral issuer to UniCredit’s Eu750m long five year deal, which was priced at almost 100bp through Italian government bonds, are seen as slim.

“I would not deem the floodgates to be open for Mediterranean issuers,” said a covered bond banker. “UniCredit is one of the two top notch issuers in Italy and I don’t expect the Spanish to do anything for now.”

He suggested that the market would see an only gradual increase in supply through to September, although another said that issuers would be better advised to come to market sooner rather than later.

“This mood will not last,” he said. “The volatility and negative headlines can return quickly and market conditions deteriorate again at the end of the summer break, and supply from the SSA world will possibly stop the rally and weight on spreads.

“The risk of repricing exists and spill-over effect could take place. I am therefore not sure that spreads will continue to tighten.”