German accounts attach ‘great weight’ to ratings despite flak

Friday, 8 July 2011

Although rating agencies have been taking flak for some of their recent actions, DZ Bank analysts said a survey of German investors shows that they continue to attach great weight to ratings. But those feeling the sharp end of rating actions may draw comfort from many investors’ satisfaction with just one rating and their ability to buy non-triple-A paper.

DZ’s findings are based on feedback from 68 German institutional investors, with banks comprising the largest group of respondents, followed by insurers and asset managers.

Of the investors surveyed, 68% said they require at least one covered bond rating, 27% at least two, and none said they require three ratings. Only 1.5% said they do not need a rating when deciding whether to invest in covered bonds.

“Despite all the criticism that has been directed at rating agencies, these numbers show that a wide majority of market participants continue to attach great weight to the opinions of credit analysts,” said DZ Bank analysts in a report explaining the survey results.

Jörg Homey, head of covered bond research at DZ, told The Covered Bond Report that the law of diminishing marginal returns captures the value an issuer derives from the number of rating agencies it employs to rate its covered bonds.

“One rating gives an issuer access to a large number of investors, with a marginal additional benefit stemming from obtaining a second rating and zero additional benefit from a third rating,” he said.

In addition to showing investors’ expectations about the number of ratings issuers should obtain for their covered bonds, the survey also revealed that buy-side requirements for rating levels are changing in line with a downward migration of ratings.

“The survey numbers show that triple-A is no longer the standard,” said Homey, “even though some very conservative investors still require that.”

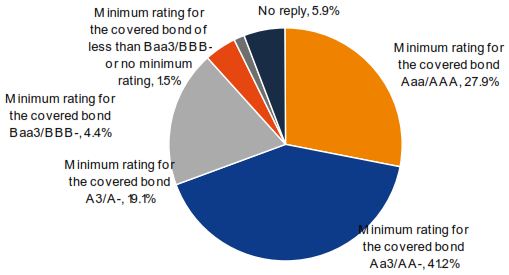

Some 28% of investors participating in the survey said they expect a triple-A rating, while 41% expect a minimum rating of double-A, and 19% are satisfied with a single-A rating.

The analysts highlighted that these minimum rating levels satisfy eligibility requirements for repo with the European Central Bank.

“We believe that this consideration also reflects the banks’ preference for liquidity as covered bond investors,” they said.

As well as minimum rating requirements for covered bonds, the survey found that 63% of those surveyed required issuers to have a minimum rating of A3/A-. Some 41% said that the covered bond rating is more important than the issuer rating in their investment decision, 34% said that covered bond and issuer ratings are of equal importance, and 18% said that the issuer rating is more important.

The survey found that 65% of respondents had an increasing investment requirement with regard to covered bonds, 12% a steady requirement, and 13% a decreasing requirement, with the balance not responding to this enquiry.

If your investment decision requires a rating, have you defined a minimum rating for covered bonds?

Source: DZ Bank