RBNZ plans for LTV restrictions credit positive, says Moody’s

Monday, 19 August 2013

Reserve Bank of New Zealand plans to restrict high loan-to-value lending in New Zealand are credit positive for New Zealand’s banks and their covered bonds, according to Moody’s.

On Tuesday the central bank released further details on its plans, responding to submissions following a public consultation on the proposed framework for high loan-to-value ratio (LVR) residential mortgage lending.

“LVR restrictions on residential mortgage lending can help to dampen excessive house price growth in periods when credit growth is boosting housing demand beyond housing supply,” said RBNZ deputy governor Grant Spencer. “In so doing, they can reduce the risk of a rapid correction in house prices and the economic and financial instability that would ensue.

“High LVR restrictions would involve setting a limit on the proportion of new high-LVR lending that banks are able to do, rather than restricting it altogether,” he added. “This ‘speed limit’ approach would enable many high-LVR borrowers to continue to obtain mortgages.”

The limit is yet to be set and introduced, with the central bank saying that it would give at least two weeks’ prior notice.

Moody’s said that the move is credit positive for New Zealand banks because they will reduce their exposures to higher risk lending at a time when house prices are at historic highs.

“The introduction of an LTV limit will benefit banks by providing a buffer against declining house prices before the size of the loan exceeds the value of the property,” said the rating agency.

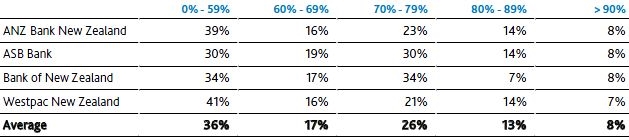

It noted that the proportion of newly originated loans (to which the limit will apply) with LTVs of more than 80% rose from 24% in October 2011 to 30% in February of this year.

Moody’s said that the move will be credit positive for covered bonds because their ratings rely primarily on bank credit quality. Additionally, the restrictions will improve the credit quality of cover pools because banks will have a smaller selection of high LTV loans to sell into these pools, it added.

“This is particularly relevant for ANZ Bank and Westpac New Zealand, which have in their cover pools the highest proportion of loans with LTVs of more than 80%, at 5.1% and 4.6%, respectively,” said the rating agency.

Major New Zealand Banks’ residential mortgage LTV ratios

Source: the banks, Moody’s. Data as of 31 March 2013