Aussie bill positive if wholesale reliance stable, says Moody’s

Monday, 26 September 2011

Moody’s said today (Monday) that an Australian covered bond bill, if enacted in its current form, would be credit positive for investors in Australian covered bonds and – as long as it does not increase a reliance on wholesale funding – issuers. The rating agency also detailed how an 8% cap could translate into A$173bn (Eu125bn/US$167bn) of issuance.

The Banking Amendment (Covered Bonds) Bill 2011 was introduced on 15 September, following a consultation on an exposure draft earlier this year. It will amend the Australian Banking Act to allow the issuance of covered bonds, which was previously prohibited.

For issuers, covered bonds could allow the lengthening of banks’ maturity profiles, said Moody’s, and diversification into new investor bases as well as sales to existing buyers of senior unsecured and government guaranteed debt. Meanwhile a 8% cap on covered bond issuance should protect unsecured creditors, added the rating agency.

However, Moody’s warned that while it would view covered bond funding as positive if it replaces other forms of secured funding, it could be considered negative if it replaces customer deposit funding, thereby increasing a bank’s reliance on wholesale funding and particularly secured funding.

Detailing those aspects of the bill that are credit positive for investors, Moody’s said: “For covered bonds, it would ensure the ring-fencing of a cover pool, support the segregation of the pool following an issuer default, and require independent cover pool monitor and minimum overcollateralisation.”

The rating agency noted that the bill does not address operation, substitution and servicer-disruption risks, but added that these could be addressed through contractual arrangements.

With regard to potential pooled issuance of covered bonds, Moody’s said that the bill “falls short” on operational details and governance for aggregated issuance and does not address liquidity, which it noted is an important rating consideration. Again, Moody’s said that these concerns may be addressed through contractual arrangements.

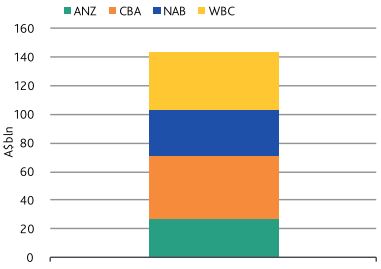

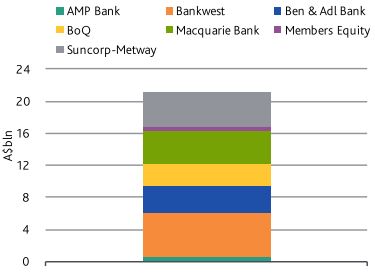

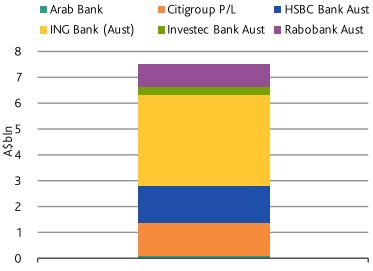

The rating agency said that the 8% limit, taken with a hypothetical 110% overcollateralisation level, should translate into issuance of around A$173bn and broke this down into three groups of issuers:

Majors – A$144bn (CBA includes BankWest)

Regionals – A$21bn (BEN & ADB includes Rural Bank)

Foreign subsidiaries – A$8bn

Source: Moody’s, APRA Statistics (data as of 31 July)